What do we call a betting platform decentralizing every facet of betting using blockchain technology? Polymarket! In 2024, the global betting market will be expanding at a phenomenal rate. For instance, statistics as reported by Forbes indicate that in 2023, Americans wagered about $119.8 billion in sports alone, a 27.5% increase from 2022. The revenue from these markets is expected to hit $16.5 billion in 2024 and nearly $30 billion by 2029. In more recent years, the betting world has seen a major revolution with the birth and growth of decentralized betting markets. One such is Polymarket Betting.

About Polymarket!

Polymarket is a trading platform enabling users to bet on the outcomes of various significant events and topics by employing the power of crypto assets. Operating on top of the Ethereum blockchain, Polymarket is among crypto’s largest decentralized betting sites.

Of course, the concept of betting markets is not new. It dates back to the 1500s as a polling system for the outcomes of Papal elections, gaining broader applications in the 1900s.

While built on Ethereum, Polymarket operates through the popular L2 network Polygon. It offers a new, redefined way for people to interact with global events and debates by employing the power afforded by blockchain technology.

Unlike most prediction markets that focus primarily on one topic, Polymarket rises with support for various topics, including sports, politics, the Olympics, pop culture, crypto, business, and science.

Launched in 2020, Polymarket is the brainchild of Shayne Coplan to provide more real-time probabilities of significant events. It harnesses collective intelligence to make well-informed predictions about future events.

Polymarket: The Growing Popularity

Despite witnessing a somewhat stagnated growth in its early days, Polymarket has grown in popularity recently.

As per analytics by Dune analysts, in October 2020, Polymarket ran a market share of just about $2.79 million. By the end of 2020, Polymarket’s volumes had surpassed the $20 million mark, reaching nearly $21 million.

However, the project saw a massive decline in activity between mid-2021 and early 2023, with the volumes dropping to as low as $1.37 million in Jan 2023. This minor setback did not completely kill the Polymarket network.

2024 oversaw the resurgence of the Polymarket network, with the platform reporting a new high in volumes at $54 million. In June, the Volumes crossed the $100 million mark, even going towards $111 million.

When writing this report, at the end of July 2024, Polymarket’s volumes had almost tripled from the preceding month, hitting a high of $324 million.

Key Features of Polymarket

Here are some key features associated with Polymarket:

- Decentralized prediction markets: The platform is decentralized, allowing user participation through the creation of markets.

- Simple market creation and trading: Users can create new markets by proposing questions or statements about future events (e.g., “Will Bitcoin reach $100,000 by the end of the year?”).

- Automated market resolution: Polymarket leverages automated solutions like oracles and dispute resolution tools to determine clear outcomes.

- Liquidity Pools: Polymarket pools liquidity from users who provide liquidity tokens. These pools facilitate trading and ensure that markets have sufficient liquidity for participants.

How-Tos for Polymarket

How To Create an Account on Polymarket

Of course, you must first sign up before using Polymarket’s services. But how do you do it?

- After opening the web page Polymarket.com, click the signup button. The network affords a few alternatives for signing up, the most popular being using your email address.

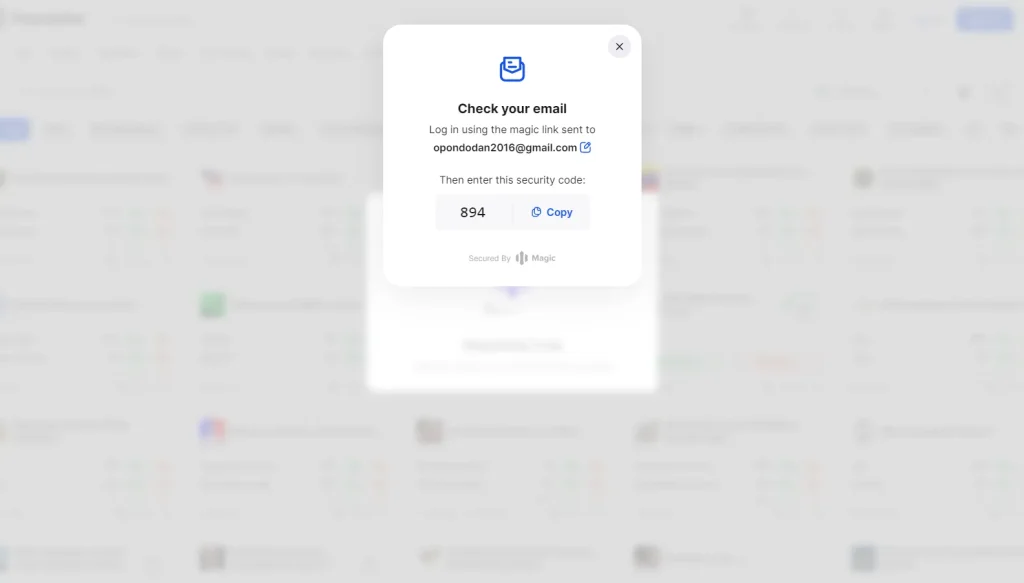

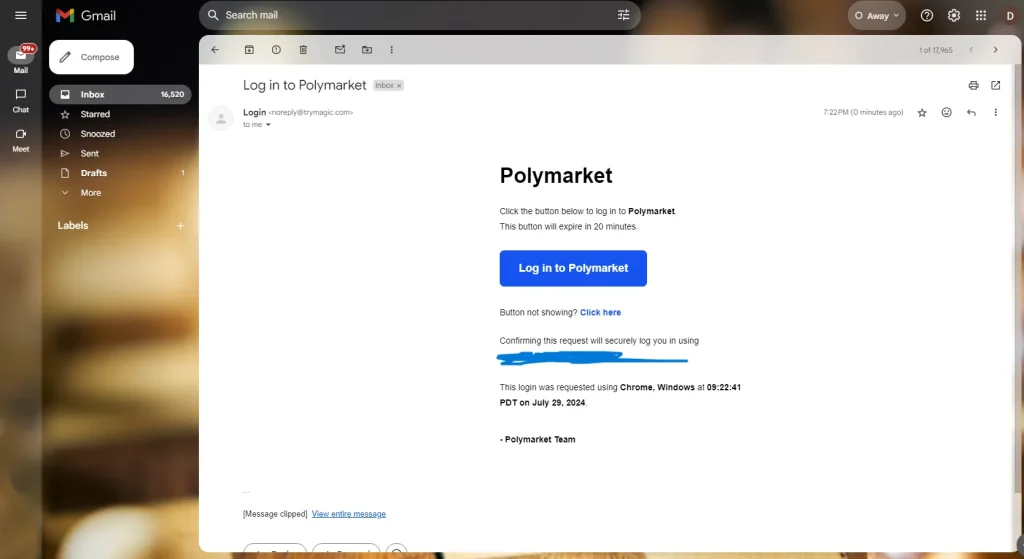

- Various signup options are given, but the most widely used is email. Click the option and write down your email address. You will receive a prompt to enter a code.

- Open your Gmail or email account in a new tab, and watch out for a new notification entitled “Log In To Polymarket.” Open the email, and click on the large blue button link.

- As a new page opens, you will need the code received in step one. Add the code and receive a prompt entitled “Login Complete!”

- You can then close the second window and return to the previous tab, where you will add your publicly visible username.

How To Fund Your Polymarket Account With USDC

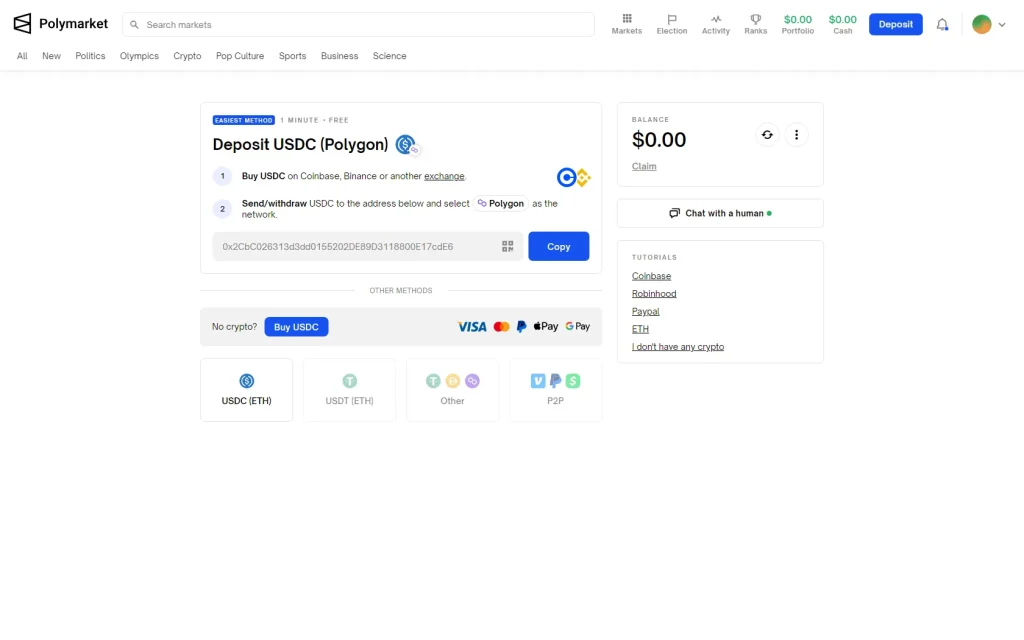

When opening the Polymarket site after login, you are immediately prompted to deposit USDC. Here is what you should do:

- If you do not own any USDC in all your crypto wallets, buy the asset from popular exchanges like Binance, Coinbase, or any other secure platform.

- If you own another type of cryptocurrency, Bitcoin, Ethereum, or USDT, you must convert it to USDC to trade on Polymarket.

- If you own some USDC in your wallets, you must transfer it from an external wallet to the Polymarket wallet using the address on the page.

Transferring the USDC from an external wallet to your Polymarket account attracts a flat fee of $0.08.

On their web page, Polymarket has provided a video and pictorial guide on the critical steps of sending funds and depositing them into the account.

How To Make Your First Trade on Polymarket

Now, you have an account with some USDC in the wallet. You can now start trading the markets. Here is a short step-by-step guideline on how to start your first trade:

Select Your Market

When trading the regular financial markets, traders often do thorough research and analysis before deciding which market pair to deal with and when to enter a trade. The case is the same for Polymarket bets. While there are dozens, if not hundreds, of markets available, it’s the duty of investors to select the one that interests them.

For instance, as of July 2024, the most popular subjects on the internet are:

- The 2024 US Elections

- The 2024 Paris Olympics

If you are into Politics, you can speculate on the outcome of the presidential elections in the US, which is easily visible on the Polymarket homepage.

However, the market you want to invest in is not readily visible on the home page. You can narrow the scope of your search using the filter tool. Spot and click the market you are interested in, and begin your trades.

Buy Shares Into The Market

The second step following market selection is the purchase of shares. Before purchasing, you can review the necessary market information, including odds, graphs, and rules.

After reviewing the necessary info, you may enter the trade by purchasing the actual shares.

You can purchase shares by:

- Click into the market. In this case, this is the Presidential Election Winner 2024 category.

- You can see a list of the participants and the share value of possible wins or losses.

- If you expect Donald Trump to win, click the YES share, valued at 60 cents. If you don’t expect a win by Trump, you can Bet NO for 41 cents.

- Feed the necessary details, including the amount you aim to purchase.

- Finally, click buy.

The network will notify you when the trade is successful. Some investors may choose to share their trades publicly.

Notice that the share values on Polymarket range between $0.01 and $1.00. The outcomes range between the positive and negative. One outcome costs a few cents, while the other could mean it is less likely to occur.

Note that after buying the shares, you have the freedom of trading them out/selling them at any given time before the market is fully resolved.

How to Sell Shares

The steps involved in selling are as follows:

- Open the individual market page and select the sell option.

- Input the number of shares you aim to sell under the ‘How Much’ box. If you want to sell everything, just input the maximum.

- Review of the trade. Agree to the terms of service and the privacy policy before clicking ‘Confirm.’

- The trace process lapses in only about 20 seconds and your shares are sold based on their prevailing value in the market.

How to Redeem Shares

But what if the market is resolved? At this point, you can no longer trade out the shares. Instead, you will need to redeem the shares.

Market resolution occurs when the event under question occurs, and the outcome is entirely determined. If, for instance, you purchase the shares associated with the US elections, market resolution occurs when the actual results are released. You will be able to redeem the shares for USDC value.

But what if the market closes with no clear outcome? What if you do not know if the result is a YES or a NO? In such cases of ambiguity, the Polymarket Market Integrity Committee MIC will determine the outcome.

All in all, at the end of market resolution, if you made the correct guess, you will earn profits, meaning you can redeem the shares:

- Navigate to the portfolio tab in your Polymarket account. In the current interface, you will find the portfolio tab in the top right corner.

- The portfolio tab displays the value of your shares and all your current positions.

- Select the resolved market and click redeem winnings, after which the USDC value of your winnings will be deposited into your wallet.

Money Making Mechanism in Polymarket

How can we make money in Polymarket? Through its betting and trading system, Polymarket affords you at least two mechanisms to earn money. They are:

Trading

Polymarket trading works almost similarly to regular exchanges, where you purchase and sell shares. This change in value between purchase and sale of shares brings investors profits or losses.

If you buy shares in a particular market with a 1% chance of happening, the probability increases to 20%; you will most likely make 19%, close to 19 cents when selling.

Back to the US presidential elections market.

When beginning the writing of this article, there was a 60% (60 cents) chance of President Trump winning the elections and a 41% (40 cents) chance of losing. However, only 24 hours later, the chance of Trump winning dropped to 55% (55 cents), and that of losing had increased to 46% (46 cents).

If you bought the No shares at 40 cents, only 24 hours later, you could sell the shares at 46 cents, gaining 6 cents in profit.

Betting

Another way Polymarket users make money is simply by waiting for the results. If you buy shares in a particular market and make accurate odds, winning the bet, you can redeem your betting profits.

Consider this: you have participated in the polymarket betting political market. The question you have primarily focused on is, “Which Party wins the 2024 US Presidential Elections?”

As per the Polymarket image above, the Democratic party has a 39% chance of winning the elections, meaning Republicans have a 61% chance. As a result, if you believe the democratic party will win, you will have to spend about 39 Cents per share.

If, at the end of the period, the democratic party wins, each share will be valued at $1, meaning you made a profit of 61 Cent. If the Republican party wins, the value of your share goes to zero.

Challenges and Opportunities Associated with Polymarket

Challenges

Polymarket, a decentralized prediction market platform, has gained significant attention recently. Here are some key aspects and challenges associated with Polymarket:

- Market volatility: Polymarkets and other prediction markets suffer from high volatility, especially in markets associated with crypto assets. These rapid price fluctuations affect investor sentiment.

- Legal and regulatory concerns: Polymarket has suffered major legal setbacks in its lifetime after being fined over $1.4 million by CFTC.

- Risk of platform failure or exploits: As a smart contract platform, Polymarket is susceptible to hacks and exploits by bad actors.

- Analytical community: Polymarket’s community is full of expert analysts who thrive and win many bets; hence, things could be hard for newcomers.

Opportunities for Polymarket

Here are some opportunities associated with Polymarket:

- Decentralized Information Aggregation: Polymarket allows users to create and trade prediction markets on various topics. Their implementation of a decentralized approach enables a better and more structured info aggregation since the market prices reflect collective beliefs and knowledge.

- Incentivized Participation: By making good predictions, Polymarket users can make good profits.

- Transparency and Auditability: Polymarket leverages a highly transparent blockchain-based infrastructure. Hence, users can verify market outcomes and settlement processes independently.

- Integration with DeFi Ecosystem: Polymarket can integrate with other DeFi protocols, creating synergies and expanding its utility.

Final Word

This guide has looked deeply into the decentralized betting world, especially focusing on one behemoth, Polymarket. This decentralized betting network affords a platform where individuals can bet and trade their bets. Already gaining popularity in social networks, Polymarket seems primed for greatness.

FAQs

Polymarket is a decentralized prediction platform where users bet on real-world events using USDC. It runs on the Polygon network built over Ethereum.

Polymarket faced legal issues in the past, including a fine from the CFTC. While it continues to operate, users should research regulations in their country.

You need USDC in your Polymarket wallet. You can buy USDC from exchanges or convert other crypto into USDC.

Yes. You earn by making accurate predictions or trading shares as their value changes.