What if there was a key to unlocking the true potential of blockchain, connecting it seamlessly with our everyday lives? Discover ChainLink. Today, at least 300 million people use blockchain technology, with at least 3.9% expected to use it in 2024, enjoying its infinite possibilities. Yet, within this revolution lies a significant problem, an Achilles’ heel in the form of disconnection from the off-chain world.

Enter ChainLink, an oracle network built to bolster blockchain connectivity to the real world.

What is ChainLink?

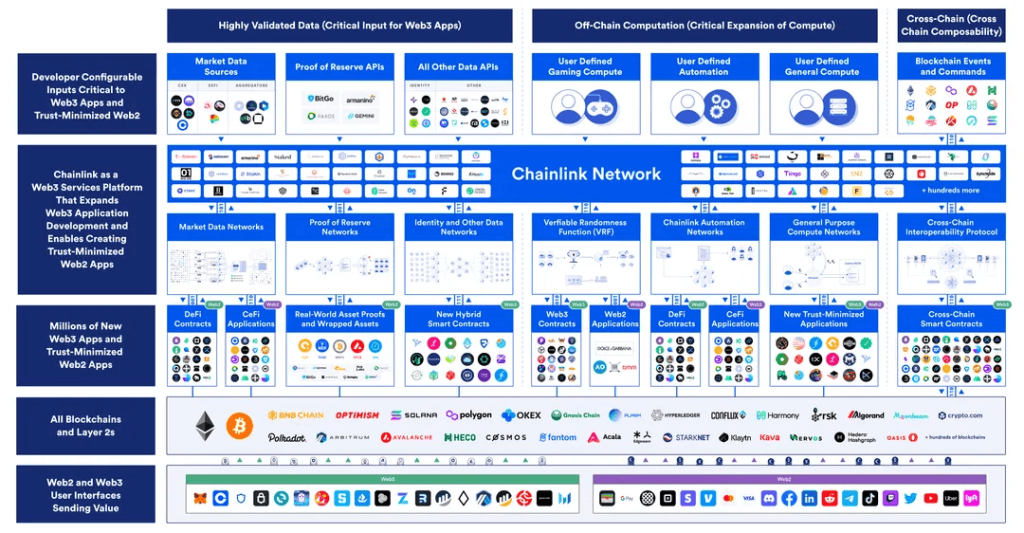

ChainLink has become a top player within the Web3 service sphere, primarily functioning as an oracle network or a blockchain abstraction layer. Its wide range of services extends across crypto, DeFi, digital gaming, insurance, and NFTs.

The founding philosophy of ChainLink was bridging the gap between non-blockchain and blockchain platforms. It acts as a digital sinew, connecting blockchain-based smart contracts to off-chain data sources like sports events and stock prices.

At its core, ChainLink embodies blockchain innovation, enabling computations on and off-chain. As such, ChainLink is the basis of hybrid smart contracts and cross-chain interoperability.

The platform achieves this feat by granting access to accurate world data across any blockchain protocol.

Interestingly, ChainLink is not a standalone chain — It’s intricately woven into the fabric of Ethereum, the epicentre of financial decentralization and home for DeFI.

Moreover, ChainLink is an open-source infrastructure. It allows developers to participate in its financial innovation, fostering a hugely transparent ecosystem.

By bridging off-chain data on-chain, ChainLink solves one of the initially severe limitations of the smart contract world. Hence, blockchains can attain their full potential.

The Problem and Solution

Of course, smart contracts have, since inception, redefined how agreements are executed. They achieve this using the decentralized and immutable nature of blockchain tech.

But, smart contracts suffer from a significant problem: they are inherently disconnected. Smart contracts suffer a major isolation from the outside world.

This is where ChainLink brings its game-changing capabilities.

ChainLink acts as a bridge between on-chain and off-chain worlds. What’s more important is that ChainLink’s oracles are highly secure and reliable for blockchain users.

How Does ChainLink Work?

As already highlighted, the primary role of ChainLink is bridging between blockchain apps and real-world apps. But how does ChainLink achieve its top mandate?

The network adheres strictly to the following line of processes:

Step 1: Oracle Selection

The initial step in the world of ChainLink is simply selecting the right Oracle. This step involves the user or Dapp creator initiating a request for info from an external source. The first contract, the ‘Requesting Contract,’ is created here.

Step 2: Service Level Agreement Contract

ChainLink registers the request and creates a new contract, the SLA contract. This contract results in three more contracts: a reputation contract, an order-matching contract, and an aggregating one.

So, what is the task of each of those three contracts? The jobs include:

- Reputation Contract: This contract verifies an oracle provider’s performance history and legitimacy, disregarding unreliable nodes.

- Order-Matching Contract: This contract solicits bids from ChainLink nodes, choosing the suitable number and type of nodes to fulfill the request.

- Aggregating Contract: This contract validates the data provided by the chosen oracles, combining the results for verification.

Step 3: Creation of SLA Contract for Oracle Selection

Users of the ChainLink network draft the SLA, specifying a set of data requirements. This is followed by the ChainLink network matching the users to the suitable oracles capable of supplying the needed data.

The user will submit their SLA and stake LINK in an order matching contract. As mentioned earlier, the contract accepts beads from Oracle providers.

Step 4: Data Collection and Processing

The oracles interact with external sources to gather the real-world data specified in the ChainLink SLA. The processed data is then returned to the buyers via the ChainLink service.

Step 5: Aggregation and Verification of Results

The collected data is aggregated and returned to the Aggregation contract. It evaluates the validity of the data points and provides the user with a weighted score based on the combined data received. The Oracle reputation system is used to determine the reliability of the data sources.

What Solutions Does ChainLink Provide?

ChainLink is the pioneer of decentralized oracles. As such, it managed to accumulate tens of billions in USD value. The platform’s success is primarily because of its solutions to the crypto ecosystem. Among these solutions include:

- Decentralized price feeds integrate with DeFI applications to provide reliable and real-time financial market data.

- Proof of Reserve – The fall of FTX in 2022 exposed the need for PoR. These proofs help simplify the processes of auditing exchanges and crypto platforms.

- Verifiable Random Function provides a fair and secure Random Number Generator (RNG) for NFTs and on-chain gaming applications.

- Automation – Dapp developers will enjoy a reliable, decentralized, and cost-effective tool for transaction execution services.

- The Cross-Chain Interoperability Protocol (CCIP) – ChainLink’s CCIP enables cross-chain apps to send messages and transfer tokens with commands across multiple blockchains.

- Modular External Adapters – These adapters allow the connection to any off-chain resource. Among the resources are premium data providers, bank payments, IoT sensors, enterprise backends, authenticated web APIs, other blockchain networks, and more.

Technical Advancements in ChainLink 2.0

As part of its constant development, ChainLink introduced the staking roadmap, marking the beginning of ChainLink economics 2.0. But what are the critical advancements of this version:

- Hybrid smart contracts

- More scaling

- Confidentiality

- Abstracting away complexity

- Order Fairness

- Trust minimization

- Crypto economics security

What Are The Use Cases of ChainLink

With the tool offerings already discussed above, it’s unsurprising that ChainLink has captured many use cases across the technology industry. Among the network’s famous use cases and integrations include:

Decentralized Finance

DeFI, a technological invention born with the inception of Ethereum, is one of the biggest beneficiaries of ChainLink’s service offerings. The disconnect between DeFI and TradFi makes it nearly impossible for the former to get real-time data about the latter.

The ChainLink-based oracles help vastly in creating DeFI products based on market data. As such, DeFI becomes enjoyable. Among the DeFI projects to benefit include:

- Synthetic assets – These financial instruments provide traders with exposure to assets without the need to hold the actual assets. They rely on ChainLink price feeds to get the prevailing value of the underlying assets.

- Money Markets – These are DeFI-based tools leveraging smart contracts to connect lenders with borrowers. They need accurate price feeds to track asset valuation of collateral and assets sent.

- Decentralized stablecoins – These stablecoins are unlike their centralized peers, backed by fiat. The decentralized stablecoins are backed by on-chain cryptos. As such, they need accurate price data from ChainLink to maintain 100% collateralization.

- Yield farming – Other DeFi solutions enjoying the support of ChainLink’s solutions include future options, algorithmic stablecoins, credit default swaps, bonds, revenue sharing, leveraged yield farming, Automated market makers, staking, real-world assets and liquidations. All these projects rely on ChainLink for Oracle data provision.

External Payments

ChainLink network affords comprehensive solutions to blockchain tech, especially regarding external payments. Some blockchain-based smart contracts can inherently issue payments in their native cryptocurrency.

However, with the volatility of crypto assets, non-crypto businesses prefer fiat assets for more stable balance sheets. ChainLink connects smart contracts to external APIs, bringing much-needed solutions.

ChainLink’s interface allows connectivity with banking networks, providing a direct path for deposits. Networks like PayPal and Stripe can access ChainLink’s solutions for retail payments.

OnChain Finance

Blockchain technology helps modernize financial systems and provides robust solutions. Processes like Asset tokenization, cross-chain transfers, corporate actions and cross-chain settlements all demand the power of ChainLink to enhance capital efficiency.

NFTs and Gaming

ChainLink developed the Verifiable Randomness Function to provide random numbers and cryptographic proof that randomness has not been tampered with. This helps issue random rewards in NFTs, dynamic NFTs, random gameplay, randomness in prediction markets, and much more.

Insurance, Supply Chains, and Government Use

Various industries, including supply chain, insurance, government, enterprise systems and identities, can vastly benefit from a wide range of tools ChainLink provides as part of its oracle offering.

What is the LINK Token?

Native within the ChainLink ecosystem is the native cryptocurrency LINK. The token has a very primary function within the ChainLink ecosystem.

LINK is an ERC-20 token within the Ethereum network. It immediately thrived as a top DeFI network on the Ethereum blockchain.

What are The Primary Roles of This Token?

- Users pay for all services within ChainLink using LINK. As mentioned, ChainLink is an oracle, a data source for on-chain projects. As such, these projects buy this data or information using ChainLink’s native token LINK.

- Staking – The staking and rewards mechanisms within ChainLink rely on LINK tokens.

- Governance token – ChainLink’s governance system relies on the power of the LINK token. LINK holders get a participant’s vote on prospective network decisions.

What are LINK’s Prospects?

LINK was trading at about $20 when this report was written. The coin has been surging speedily in recent weeks. However, LINK’s all-time high stands at about $50. This means that the token is still way below its all-time high.

However, with the incoming Bitcoin halving and the buzz around it, LINK will likely trade speedily and even recover to its all-time high. Analysts predict a possible 10x gain for LINK tokens in the next 18 to 24 months. As such, LINK will likely hit $150 to $250 in the next bull run.

With many blockchain projects looking to use ChainLink’s Oracle services, the demand for LINK will only increase. As such, we can already see a future where LINK trades above $1K.

Where Can You Buy LINK?

Seeing LINK’s prospects, the only reasonable conclusion for many investors would be to purchase it now when it’s still below $20. But the big question is, where can you buy LINK today?

Well, being among the most popular assets in the crypto realm, LINK also stands among the most easily available assets to invest in. It is readily available across all top-tier crypto centralized and decentralized exchange networks.

Here is a short rundown of the platforms where you can purchase LINK:

- Binance – The largest crypto exchange network almost immediately saw the potential of LINK tokens in its early years. As per reports, Binance listed ChainLink back in 2017. The most popular markets on Binance are LINK/USDT, LINK/FDUSD and LINK/BTC.

- Coinbase – One of the most trusted exchanges in the crypto universe primarily offers the LINK/USD, LINK/EUR and LINK/BTC pairs.

- OKX – another popular exchange that supports the LINK/USDT pair

- Bybit – Bybit’s most popular LINK market is paired with USDT.

Other exchanges like KuCoin, Gate.io, Uniswap HTX and Kraken have become reliable homes for LINK.

Final Word

ChainLink is a transformative force in the Web3 landscape, offering vital services using its decentralized oracles. It focuses on connecting the deterministic realm of blockchain with off-chain data.

Using its Oracle services, ChainLink bridges the gap of information. Hence, smart contracts can easily interact with external sources of data. These off-chain data sources offer information critical to gaming, NFTs, DeFI, insurance, and more.

The native token LINK facilitates operations within the ChainLink ecosystem and represents a stake in its governance and future. Its price performance in the last few weeks is a testament to the token’s potential as an investment.

Frequently Asked Questions

What is a blockchain oracle?

A blockchain oracle is a system that provides smart contracts with data from off-chain systems. Basically, oracles connect blockchain with real-world data.

What is “Real-World Data”?

This refers to info or data which exists off blockchains. It includes global data from exchanges, sports, gambling sites, Forex markets and more.

What are Hybrid Smart Contracts?

These are smart contacts secured using both onchain and offchain computing systems. They are only possible because of ChainLink’s Decentralized Oracle Networks.