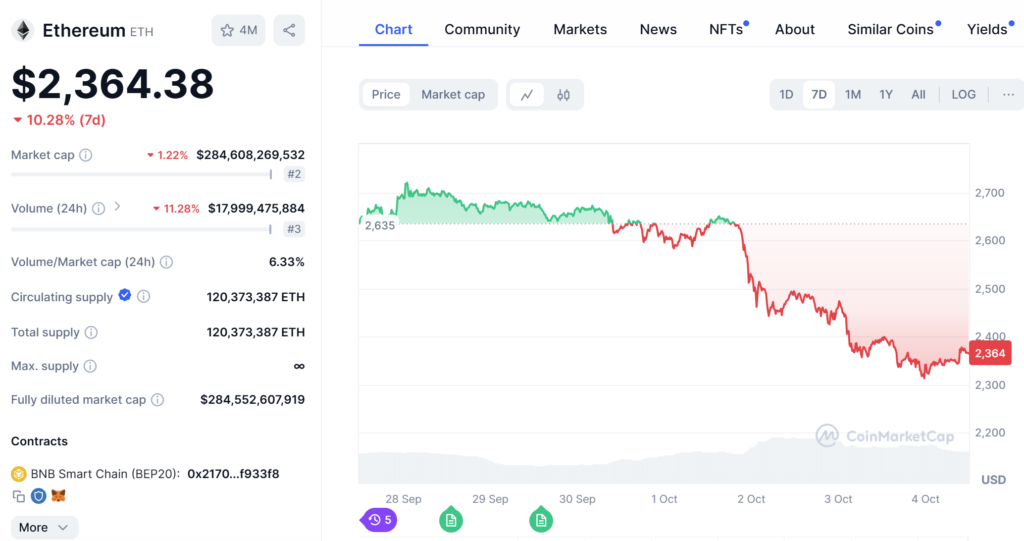

Ethereum, the second-largest blockchain by market capitalization, has experienced a notable price drop, falling below $2,400. This decline mirrors the broader crypto market’s downturn, which has seen a nearly 2% drop in total market cap to $2.17 trillion. Despite the decline, there’s been significant Ethereum accumulation around the $2,350 level.

What Does This Mean for Ethereum?

Data from IntoTheBlock shows that approximately 1.89 million Ethereum addresses have accumulated 52 million ETH between the $2,311 and $2,383 range. This indicates that the $2,350 price point could play a critical role as traders continue to engage in Ethereum accumulation at this level.

“Blockchain and crypto technologies remain resilient, and Ethereum’s community is demonstrating confidence despite the recent market correction,” noted a market analyst.

Key Highlights of the Ethereum Accumulation:

- 1.89 million addresses bought 52 million ETH between $2,311 and $2,383.

- The $2,350 price aligns with key Fibonacci retracement levels, commonly viewed as support zones in volatile markets.

How Does This Impact Ethereum’s Market Position?

Despite recent declines, the accumulation of ETH at $2,350 suggests that traders believe in Ethereum’s long-term value. However, sellers currently hold the upper hand, with market movements heavily influenced by actions from centralized exchanges.

Ethereum’s Market Activity:

- Significant Ethereum accumulation has led to ETH outflows from centralized exchanges.

- Leading market makers like Wintermute moved 14,221 ETH to Binance, likely signaling more sell pressure.

What’s the Regulatory Perspective?

While Ethereum continues to dominate the DeFi and NFT sectors, regulatory developments and market sentiment will play a major role in its recovery. Observers are closely watching how the market responds in the $2,100–$2,350 range, as Ethereum accumulation in this range may shape Ethereum’s near-term trajectory.

Ethereum’s Future Outlook:

If Ethereum maintains its support around $2,350, it could see a recovery to the $2,800 range. However, if sell pressure pushes the price below this level, ETH could revisit its August lows around $2,000 or even fall further to $1,800. Ethereum accumulation will be key to observing future price movements.