Staking is a way to earn crypto by locking up your coins to help run a blockchain. You get rewarded just for holding and staking your tokens. It’s like earning interest—but crypto style.

Let’s break it down without the techno-babble. You’ve got some coins. Instead of letting them sit in your wallet like lazy couch potatoes, you lock them up (aka stake them). That helps a blockchain network stay secure and functional. In return, the network gives you rewards—usually more of the same coin. Think of it like putting money in a savings account, but with way higher returns (and a bit more risk).

What’s the Purpose of Crypto Staking?

Crypto staking helps secure and run a blockchain network, while giving users a way to earn rewards.

At its core, staking serves two big purposes: it keeps the blockchain running smoothly, and it rewards people who help make that happen. Instead of relying on massive energy use like Bitcoin’s mining model, staking uses something called Proof of Stake (PoS). It’s faster, cheaper, and—honestly—a lot easier to participate in.

When you stake your coins, you’re basically locking them up to support the network. This helps confirm transactions, prevent fraud, and keep the system decentralized. The more people stake, the more secure and efficient the network becomes.

But here’s the part that gets everyone interested—you get paid for it. The network gives you extra coins as a “thank you” for helping out. It’s like earning interest from a savings account, except the returns can be way higher, and you’re part of something way cooler than traditional finance.

Staking also gives crypto projects more long-term stability. People who stake are usually in it for the long haul. That means fewer wild sell-offs and a stronger community holding the coin together.

Understanding Staking Rewards

Staking rewards are what you earn for locking up your crypto to support a blockchain network. They’re paid out in the same or related cryptocurrency.

When you stake your coins, you’re basically saying, “Hey, I trust this network and want to help it run.” The blockchain returns the favor by giving you rewards. These are usually paid daily, weekly, or per block—depending on the coin and platform.

But the amount you earn isn’t random. Rewards depend on a few things: the type of coin, how many tokens you stake, how long you lock them up, and the overall staking participation on the network. Some coins offer flexible staking with lower returns. Others give you more, but only if you lock your funds for weeks or months.

There’s also something called APY (Annual Percentage Yield). This shows you how much you could earn in a year. For example, staking Solana might earn you 6% annually, while staking a smaller coin like Cosmos could bring 10% or more. But keep in mind—crypto prices swing, so your “real” earnings in dollars may go up or down.

Some platforms also offer compounding rewards. That means your earned tokens automatically get re-staked, helping your rewards grow faster—kind of like interest on interest.

In short, staking rewards are your crypto’s way of saying, “Thanks for sticking around.” But how much you earn depends on how—and where—you stake.

Staking rewards for specific coins

Here’s a comparison table showing APY rates, lock-up time, minimum stake, and reward frequency for popular staking coins like ETH, ADA, SOL, DOT, and ATOM (based on the latest typical ranges from major platforms and native chain protocols as of early 2025):

| Coin | Estimated APY (%) | Lock-Up Time | Minimum Stake | Reward Frequency |

|---|---|---|---|---|

| ETH | 3.5% – 5.0% | 24 hours (unbonding on exit queue) | 32 ETH (native) / No minimum (via pools) | Every 6–12 days (varies by validator) |

| ADA | 2.9% – 4.5% | None (fully liquid) | 5 ADA | Every 5 days (per epoch) |

| SOL | 6.0% – 7.5% | 2–3 days (depends on validator) | 0.01 SOL (varies) | Daily or per epoch (2 days) |

| DOT | 12% – 14% | 28 days (unbonding) | 10 DOT | Daily (paid per era ~24h) |

| ATOM | 15% – 19% | 21 days (unbonding) | 0.05 ATOM (varies by validator) | Every block (~6–7 seconds) |

Take into an account:

- APY ranges depend on validator performance and network conditions.

- Minimum stake varies if staking through exchanges or liquid staking platforms.

- Lock-up periods apply mostly to native staking (not exchange staking or liquid staking).

- Platforms like Lido, Rocket Pool, or Binance Staking may offer liquid or flexible options with different terms.

How Much Can You Earn by Staking Crypto?

Most staking coins offer anywhere from 4% to 20% per year, depending on the coin, platform, and lock-up terms.

Some platforms will flash double-digit rewards in your face. Sounds great, right? But high percentages usually come with a catch—either more risk, longer lock-ups, or a token that’s not so stable. Just because something offers 18% APY doesn’t mean you’ll actually walk away richer, especially if the coin drops 50% in value.

Safer, more established coins like Ethereum, Cardano, and Solana tend to offer lower returns—usually in the 4% to 7% range. Riskier or newer tokens might push 15% to 20% or more, but that often means the token’s still unproven or super volatile.

Where you stake also matters. Centralized exchanges might offer lower returns but with easier setup and support. Decentralized wallets or staking pools may offer more—but require a bit more know-how.

Some platforms offer fixed rewards. Others have dynamic rates that change based on network activity, number of stakers, and inflation controls. Always read the fine print before locking your coins away.

The bottom line? You can earn steady rewards. Just don’t let the high numbers blind you to the risks.

Staking Through Centralized Exchanges: Simple, But Less Control

Staking through platforms like Binance and Coinbase is one of the easiest ways to earn rewards from your crypto. You don’t need to set up a wallet, choose a validator, or worry about lock-up periods manually. These exchanges handle everything for you.

Unlike traditional on-chain staking, where you keep control of your private keys and stake directly on the blockchain, centralized staking means the platform holds your assets. You trade control for convenience.

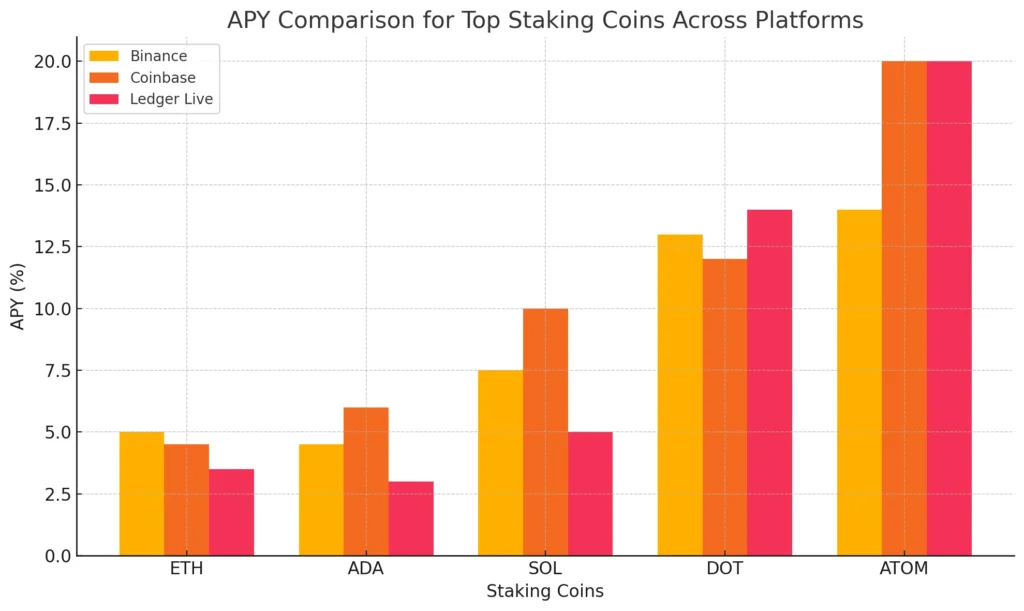

Based on the comparison chart:

- ETH offers up to 5% APY on Binance.

- SOL goes as high as 10% on Coinbase.

- DOT reaches around 13% on Binance.

- ATOM can hit 20% on Coinbase.

These rates are often higher than what you’d get from wallets like Ledger Live, and they’re usually auto-compounded. But remember, centralized exchanges can change terms or limit withdrawals.

In Short:

- Easy and beginner-friendly

- You give up custody of your coins

- Often higher APY than cold wallets

- Less transparency and more platform risk

This kind of staking is perfect if you want to grow your crypto passively without dealing with the technical side. But if self-custody and full control matter to you, native or wallet staking might be better.

Why Do People Stake Crypto?

People like staking because it’s simple. You’re not staring at charts or trying to guess the next big pump. There’s no need to wire up a mining rig or figure out cooling systems in your basement. You just lock your coins, and they quietly earn while you go about your day.

One of the biggest reasons people choose staking is that you don’t need any special hardware. Unlike mining, which eats up power and requires some serious gear, staking only needs a phone or computer—and an internet connection. That’s it. You also don’t need to sell your crypto to see a return. When you stake, you keep your coins. They stay in your wallet or on a platform, and you earn more of the same token as a reward. That means you’re still in the game, holding your position, while your balance grows on its own.

Another reason? It’s passive. Completely passive. You can stake and walk away. No need to manage trades or set alarms for market dips. If the network’s running, your crypto’s working. Many staking coins even offer flexibility. Some lock your funds for a fixed period, but others let you unstake anytime. That gives you more control and less stress if you suddenly need access to your funds.

Staking is accessible. You don’t need a huge wallet to start. Some platforms let you stake with as little as a few bucks. You can test the waters without diving in headfirst.

And finally, compared to day trading, staking also feels way less risky. You’re not making quick decisions or watching candles jump all over the place. You’re holding, earning, and skipping the emotional rollercoaster.

What are the Risks associated with Crypto Staking?

Staking is safer than trading or mining, but it still comes with risks.

You’re not gambling on short-term price swings. You’re not investing in shady altcoins (hopefully). But that doesn’t mean staking is risk-free.

The biggest risk? The value of your coin. If the price drops hard while your tokens are locked, your rewards might not cover your losses. Earning 10% APY won’t help much if your coin drops 40%. Some coins also require you to lock up your tokens for days, weeks, or even months. During that time, you can’t move or sell them. If the market crashes, you’re stuck watching from the sidelines.

Then there’s platform risk. If you stake through a centralized exchange and it gets hacked or shuts down, your funds could vanish. If you’re using a sketchy wallet or a random validator, same thing—you could lose access to your coins, or just never see rewards.

And don’t forget smart contract bugs. Even trusted decentralized platforms aren’t immune to flaws in the code. That’s part of being in crypto—high reward, high responsibility.

Is Staking Crypto Right for You?

Staking makes sense if you believe in the coin long-term and want steady rewards without trading daily.

If you’re not into chasing green candles or guessing the next pump, staking gives you a quieter, more predictable way to grow your crypto. You hold, you earn, you chill. It’s perfect for people who want to build wealth over time, not overnight. You don’t need to be a pro. You don’t need fancy tools. And you don’t need to check your phone every 5 minutes.

But—it’s not for everyone. If you panic when prices drop or need quick access to your funds, locking your coins might feel like a trap. Some staking setups require patience. Others need a bit of technical setup. If that sounds like a headache, start small—or use flexible staking with no lock-up.

Final Thoughts

Staking isn’t a shortcut to getting rich—but it’s a smart way to earn more from the crypto you already hold.

It turns idle coins into something useful. You help power a network, and the network rewards you back. No trading, no guesswork, no stress (most of the time).

It’s not without risks. Coins can drop in value. Some platforms aren’t trustworthy. Lock-ups can limit access when you need it most. But with a little research and a solid choice of coin, staking can be a strong move in your crypto playbook.

So, if you’re holding and not earning—why not put your crypto to work?

Just stake smart, stay informed, and let your coins do some of the heavy lifting.

FAQs

Binance and Coinbase are easy to use and have solid guides, but they take a cut of your rewards.

Not always. Some coins have low entry points. You can start staking ADA with just a few bucks.

Yes. Many wallets like Trust Wallet or exchanges like Binance offer mobile staking.