One of the first applications of blockchain technology other than cryptocurrencies was the creation of non-fungible tokens or NFTs. Artists and creative professionals moved to the NFT industry during the early stages of COVID-19 to make money from digital artwork. But creating NFTs isn’t free. After joining the movement, several inventors received surprise costs in the shape of NFT gas fees. In this article, we’ll break down what NFT gas fees are, how they work, and most importantly, how you can reduce them.

What is an NFT gas fee?

NFT gas fees represent the costs of completing a transaction on a blockchain. Every action, whether it’s minting, buying, or selling NFTs, requires computational power. Gas fees cover this work. Essentially, gas fees are the price you pay to keep the blockchain network running smoothly. The more complex the transaction, the higher the NFT gas cost.

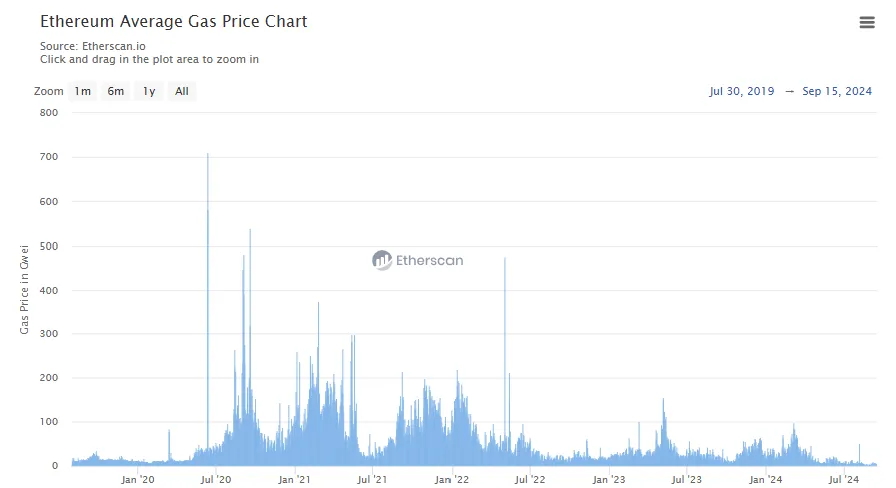

Gas fees are usually measured in gwei, a small fraction of Ether. One gwei equals one-billionth of an Ether. The amount you pay can change based on how busy the network is and how much computational power your transaction needs.

In 2021, Ethereum gas fees reached an all-time high of over $60 per transaction, with some users paying as much as $1,000 during peak NFT drops. By comparison, in early 2020, gas fees ranged from $0.10 to $0.20 per transaction, showing how much the NFT boom drove up prices.

How Gas Fees Work?

Blockchain is a digital record of every transaction ever made on a network of blockchains. The ledger is shared by all miners, which are powerful computers that run the network and validate transactions. These miners validate transactions and maintain the network. Whenever you request a transaction, such as minting an NFT, miners process and confirm your request. To compensate miners for their efforts, the network charges gas fees. That applies to PoW (Proof of work) networks. There are also concepts of networks such as PoS (Proof of stake), where stakers share the revenue from the gas fees.

When an artist creates an NFT on an NFT marketplace, then they have to mint the artwork, which records the asset on the blockchain. “Lazy minting” is the process of producing the NFT without putting it on a chain to avoid paying the associated gas.

The highest recorded gas fee in Ethereum history occurred in September 2020, when a user mistakenly paid 2.6 million gwei (worth $23.5 million at the time) for a $130 transaction. While this was an extreme case, it highlights the volatility and unpredictability of gas fees on Ethereum.

How to calculate NFT Gas Fees?

In the blockchain world, gas fees represent the computational work required to process and validate transactions, ensuring the security and integrity of decentralized networks. The two primary components of gas fees are the Gas Limit and Gas Price. The Gas Limit establishes the maximum computational work a block can handle, while the Gas Price determines the amount of cryptocurrency a user is willing to pay for each unit of gas. The total transaction cost is calculated by multiplying the Gas Limit and Gas Price, influencing the priority of a transaction in the mining process.

The equation to calculate gas fees in a blockchain transaction is:

Gas Fees = Gas Limit × (Base fee + Priority fee)

Where:

- Gas Fees represent the total cost of the transaction in the cryptocurrency of the blockchain (e.g., Ether for Ethereum)

- Gas Limit is the maximum amount of computational work that a block can accommodate

- The basic fee is fixed by the blockchain network

- Priority fee is a reward for miners/validators to prioritize certain transactions over others.

Smart contracts, often associated with NFTs, can increase gas fees due to their complexity. Network Traffic during peak times also impacts gas fees, as users compete for transaction processing, leading to higher Gas Prices.

Why are NFT Gas Fees High?

Several factors can lead to high NFT gas costs:

- Network Congestion: Popular blockchains, like Ethereum, often face congestion when many users try to process transactions simultaneously. More users mean higher gas fees as they compete for limited block space.

- Smart Contract Complexity: NFT transactions use smart contracts, which are self-executing pieces of code. More complex contracts need more processing power, resulting in higher gas fees.

- Ethereum’s Popularity: Ethereum remains the leading platform for NFTs. However, its popularity often leads to scaling issues, pushing up gas prices. Solutions like Ethereum 2.0 aim to address this by reducing fees.

- Increased NFT Demand: The growing interest in NFTs results in more transactions, which increases competition for blockchain resources, further driving up gas prices.

How to Lower Fees?

Luckily, there are ways to minimize NFT gas fees. Here are a few tips:

- Trade During Off-Peak Hours: Blockchain networks have busier and quieter periods. Try making transactions late at night or early in the morning when fewer people are using the network.

- Adjust the Gas Limit: Some wallets let you manually adjust the maximum gas fee you’re willing to pay. Lowering your gas limit may slow down the transaction, but it can save you money.

- Monitor ETH Prices: Since gas fees are paid in Ether, the cost can rise when the price of ETH increases. Be sure to check current market prices before making any transactions.

- Choose Slower Transaction Times: If you’re not in a rush, selecting a slower transaction option can reduce your gas fees. However, keep in mind that the transaction might take longer to confirm.

Additionally, Layer 2 scaling solutions like Polygon have emerged as a way to reduce NFT minting costs to less than $1 in many cases, compared to the $5 to $15+ on the Ethereum mainnet.

Conclusion

NFT gas fees remain an unavoidable part of using blockchain technology. However, by understanding how they work and following a few smart strategies, you can lower your NFT gas costs and make the process more affordable. However, there is no doubt that options with no gas will gain popularity soon to make purchasing a little easier for average consumers.

During the 2022 crypto bear market, Ethereum gas fees dropped as low as $1 to $2, compared to $20 to $50 during the 2021 bull run. This highlights the importance of timing your transactions and considering alternative blockchains like Solana for cheaper NFT activities.

FAQ – Frequently Asked Questions

You can avoid gas fees for NFTs by using platforms that offer lazy minting, where the buyer pays the gas fee when purchasing, or by using Layer 2 solutions like Polygon that have lower or no gas fees.

NFT gas fees are usually lowest during periods of low network activity, such as late at night or early in the morning, depending on your time zone.

You can buy NFTs without gas fees by using Layer 2 solutions like Polygon or exploring platforms that offer gas-free transactions, such as certain NFT marketplaces with built-in fee reductions.

NFT gas fees are calculated by multiplying the Gas Limit (the amount of computational work required) by the sum of the Base Fee and any optional Priority Fee for faster processing.