The Ethereum network was the first blockchain that introduced smart contracts and decentralized applications (DApps). Originally conceptualized by Vitalik Buterin in 2013, Ethereum launched in 2015 and has since evolved into one of the most powerful blockchain platforms. Unlike Bitcoin, which primarily serves as a digital currency, Ethereum provides a Turing-complete programming language that enables developers to build diverse applications.

Key Takeaways

- Ethereum is more than a cryptocurrency – it powers smart contracts and dApps.

- It runs on a Turing-complete blockchain, enabling complex applications.

- Smart contracts automate agreements, reducing the need for intermediaries.

- Ethereum switched to Proof-of-Stake, improving efficiency and scalability.

- $ETH fuels transactions and smart contracts across the network.

- It supports DeFi, NFTs, and DAOs, shaping the future of finance and governance.

Ethereum’s Origins and Evolution

Ethereum was developed to address the limitations of Bitcoin’s blockchain technology. While Bitcoin introduced the concept of a decentralized ledger, Ethereum expanded this by integrating programmable smart contracts that execute automatically when predefined conditions are met. This innovation has led to the creation of various applications beyond simple transactions, including decentralized finance (DeFi), non-fungible tokens (NFTs), and enterprise blockchain solutions.

Key Developers and Organizations

Ethereum’s development was spearheaded by notable figures such as Vitalik Buterin, Gavin Wood, Charles Hoskinson, and Joseph Lubin. Several organizations, including the Ethereum Foundation, ConsenSys, and the Enterprise Ethereum Alliance (EEA), have played significant roles in its growth. These entities have contributed to Ethereum’s continuous upgrades and widespread adoption in industries like finance, healthcare, and supply chain management.

Core Components of the Ethereum Network

Ether ($ETH) – Ethereum token

Ether ($ETH) is the native cryptocurrency of the Ethereum blockchain, serving multiple essential functions beyond simple transactions. It acts as both a store of value and a utility token, powering smart contracts, decentralized applications (dApps), and transaction fees.

Issuance and Supply Model

Unlike Bitcoin’s fixed supply of 21 million BTC, Ethereum’s issuance model is dynamic. Initially, Ethereum followed an inflationary model where 5 ETH per block was rewarded to miners. However, Ethereum’s supply growth rate has decreased over time, particularly after major upgrades:

- Ethereum’s Initial Supply Model:

- In the genesis block, 72 million ETH were pre-mined.

- 60 million $ETH were sold to investors in the 2014 initial coin offering (ICO).

- 12 million $ETH were allocated to developers and the Ethereum Foundation.

- Proof-of-Stake (PoS) and ETH Issuance Post-Merge:

- The Ethereum Merge (2022) transitioned the network from Proof-of-Work (PoW) to Proof-of-Stake (PoS), replacing miners with validators who stake ETH to secure the network.

- This upgrade significantly reduced ETH issuance from ~4.3% to ~0.2% per year, making it more sustainable.

- $ETH is now deflationary due to EIP-1559, which introduced a base fee burn mechanism, removing $ETH from circulation.

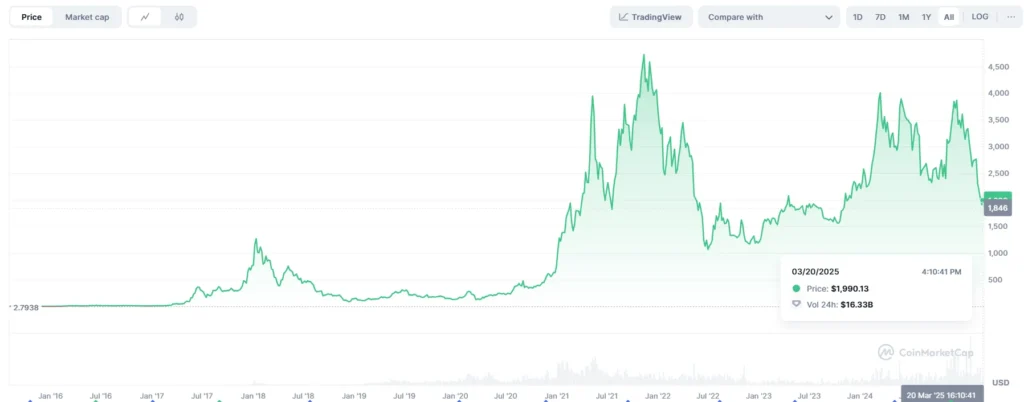

Ether token ($ETH) price

Ethereum ($ETH) is currently trading at $1,990, with a 24-hour trading volume of $16.33 billion. The price has seen significant volatility, peaking above $4,500 during past cycles and experiencing corrections along the way. Despite fluctuations, ETH continues to hold strong as one of the leading cryptocurrencies.

Accounts and Addresses

Ethereum uses two types of accounts:

- Externally Owned Accounts (EOAs) – controlled by private keys.

- Contract Accounts – controlled by smart contract code.

All transactions require a unique Ethereum address, which is derived from the user’s public key.

Ethereum Virtual Machine (EVM)

The Ethereum Virtual Machine (EVM) is the core execution environment for smart contracts and decentralized applications (dApps) on the Ethereum network. It acts as a global, decentralized computer that ensures all computations run consistently across all network participants.

Key Functions of the EVM

The EVM provides a secure and isolated runtime environment for executing smart contracts. Its main responsibilities include:

- Smart Contract Execution: Every contract runs in a sandboxed environment, ensuring that code execution is deterministic and secure across all Ethereum nodes.

- State Management: The EVM maintains Ethereum’s state, recording transactions, balances, and smart contract data.

- Gas Fees and Resource Allocation: Each computation consumes gas, preventing network spam and ensuring efficient resource usage.

- Decentralized Computation: All Ethereum nodes replicate the EVM, verifying smart contract execution and maintaining consensus.

EVM Bytecode and Smart Contract Deployment

- Smart contracts are written in high-level languages like Solidity or Vyper and then compiled into EVM bytecode.

- The bytecode is immutable once deployed, meaning that contracts run exactly as programmed.

- Ethereum uses an account-based model, where contract accounts store executable code and user accounts interact with them via transactions.

EVM Compatibility and Multi-Chain Adoption

Due to its robust and flexible architecture, the EVM has become the industry standard for blockchain smart contracts, leading to:

- EVM-compatible blockchains such as Binance Smart Chain, Avalanche, and Polygon, which extend Ethereum’s capabilities while maintaining interoperability.

- Layer 2 scaling solutions (e.g., Arbitrum, Optimism) that run EVM-based smart contracts while reducing congestion on the main Ethereum chain.

- Cross-chain bridges, allowing assets and data to move seamlessly between Ethereum and other EVM-compatible networks.

Gas and Transaction Fees

Gas is the fuel that powers the Ethereum network, measuring the computational effort required to execute transactions and smart contracts. Every operation, from sending ETH to deploying complex smart contracts, consumes gas. Users set gas limits and gas prices to determine the maximum amount they are willing to pay for execution.

How Gas Works

- Gas Limit: The maximum amount of gas a user is willing to spend on a transaction.

- Gas Price: Measured in gwei (1 gwei = 0.000000001 ETH), this is the amount a user pays per unit of gas.

- Total Cost: Transaction cost = Gas Used × Gas Price

- Unused Gas: Any unused gas from a transaction is refunded to the sender.

Ethereum’s Transition to Proof-of-Stake (The Merge)

In September 2022, Ethereum completed The Merge, shifting from PoW to PoS. This transition aimed to enhance scalability, security, and sustainability. Under PoS, validators are chosen to create new blocks based on the amount of staked ETH, significantly reducing the network’s carbon footprint.

Post-Merge Gas Optimizations

With Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) via The Merge, transaction processing has become more energy-efficient and cost-effective. Key changes include:

- Lower Energy Consumption: PoS eliminates the need for mining, reducing energy use by over 99%.

- Optimized Gas Usage: Ethereum’s EIP-1559 upgrade introduced a base fee (burned to regulate supply) and a priority fee (tip to validators), improving fee predictability.

- Layer 2 Scaling Solutions: Networks like Arbitrum, Optimism, and zk-Rollups process transactions off-chain, reducing congestion and lowering fees.

Ethereum’s Fee Mechanism: EIP-1559

Before EIP-1559, Ethereum used a first-price auction model, where users bid for block space, often leading to high fees. The new model includes:

- Base Fee: Automatically adjusted based on network demand and burned after the transaction.

- Priority Fee: Optional tip to incentivize faster transaction processing.

- Max Fee: The maximum total gas fee a user is willing to pay.

Applications of the Ethereum Network

1. Decentralized Finance (DeFi)

Ethereum is the backbone of the DeFi ecosystem, enabling platforms like Uniswap, Aave, and Compound to offer financial services without intermediaries. Users can trade assets, borrow funds, and earn interest in a trustless environment.

2. Non-Fungible Tokens (NFTs)

Ethereum pioneered the NFT revolution with the ERC-721 and ERC-1155 token standards. NFTs represent ownership of digital assets, such as art, collectibles, and virtual real estate. Platforms like OpenSea, Rarible, and Foundation thrive on Ethereum’s infrastructure.

3. Smart Contracts and DAOs

Ethereum facilitates Decentralized Autonomous Organizations (DAOs), allowing communities to govern projects democratically. Smart contracts execute decisions based on predefined rules, eliminating the need for centralized authorities.

4. Enterprise Blockchain Solutions

Leading enterprises, including Microsoft, J.P. Morgan, and IBM, leverage Ethereum’s technology for supply chain management, identity verification, and financial settlements. Private Ethereum networks offer scalability and compliance tailored for corporate use.

Challenges and Future Developments

Despite its success, Ethereum faces challenges related to scalability and transaction costs. The introduction of Layer 2 scaling solutions like Optimistic Rollups and zk-Rollups aims to improve throughput and reduce congestion.

Ethereum’s roadmap includes:

- Dencun Upgrade – Enhancing transaction efficiency.

- Pectra Upgrade – Introducing further scalability features.

- Ethereum 2.0 Sharding – Splitting the network into smaller chains to handle more transactions simultaneously.

Conclusion

The Ethereum network continues to lead blockchain innovation, driving advancements in DeFi, NFTs, and enterprise applications. With ongoing upgrades and an expanding ecosystem, Ethereum is well-positioned to shape the future of decentralized technologies.

FAQs

Unlike Bitcoin, which mainly serves as a digital currency, Ethereum offers a Turing-complete programming language that enables smart contracts and dApps. This makes it a more flexible and programmable blockchain platform.

Smart contracts are self-executing agreements with predefined rules written in code. They automatically execute when conditions are met, removing the need for intermediaries.

The Ethereum Virtual Machine (EVM) is the computing environment that processes smart contracts and transactions on the Ethereum blockchain. It ensures that all computations are executed consistently across the network.

The Merge was Ethereum’s transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS) in 2022. This change improved energy efficiency, reduced transaction fees, and made Ethereum more sustainable.