What do you call the network fashioned to return the true meaning and value of money? Well, i’t the Quai Network! But, what is the Quai Network? How does it work? What are its features?

Key Takeaways:

- Ways to Join: Mine Quai, develop apps, run a node, or join the community.

- Energy-Based Stablecoin: QI is a stablecoin tied to energy costs.

- Scalable Blockchain: Uses PoEM and sharding for fast, efficient transactions.

- Dual-Token System: Quai (deflationary) and QI (stablecoin) power the network.

- Built for Developers: Supports smart contracts and Dapps.

- Growing Ecosystem: Includes exchanges, DAOs, NFTs, and gaming projects.

- Strong Backing: Supported by major crypto venture firms.

What Is Quai Network?

Quai is defined as a scalable and programmable PoW blockchain network fashioned to bring a modern global monetary system. The Quai Network boasts the introduction of the first energy dollar, a product created through the merge of currency and energy.

In other more simple words, the Quai network is building the first ever energy-based stablecoin with utmost platform scalability. Let’s explore the duo.

When writing this review, the Quai Network was already in the testnet and development period. Our guide digs deep into this new network, and what is anticipated of it.

Energy Based Stablecoin

At the heart of the Quai network is a stablecoin known as QI which is tied directly to energy. In general, unlike stablecoins backed by other assets like Gold or even the USD, QI uses market incentives to drive the price towards the cost of energy.

Quai is not the pioneer of this class of decentralized Proof of Work stablecoins. It joins the likes of Hacash and Themelio which are already leading in this space.

Unleashed Scalability

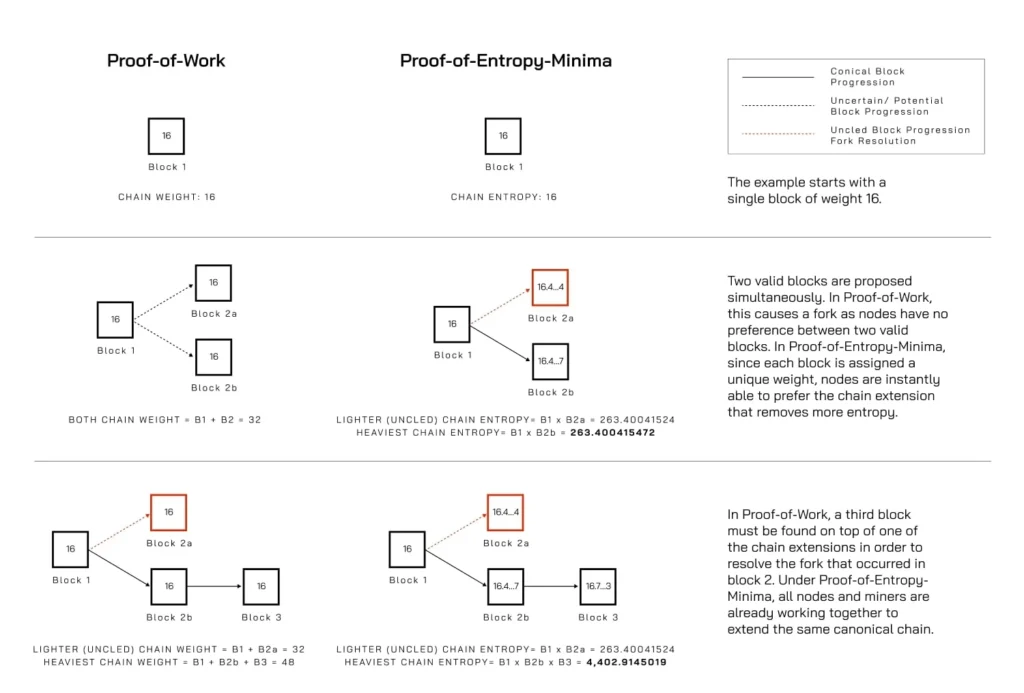

Also native within Quai Network is Proof-of-Entropy-Minima (PoEM). PoEM is primarily a proof of work fork. Through the use of this system, Quai Network achieves consensus while expanding through shards.

In essence, the Quai network is capable of adding shards to meet the constantly growing demand. Through sharding, the general network throughput greatly increases with the increase in shards.

Quai Network: The Features

PoEM Consensus

PoEM functioned by measuring the intrinsic block weight to calculate randomness removed by proposed blocks. By calculating randomness, this PoEM ensures that all nodes will prefer a specific block over others, ensuring perpetual consensus.

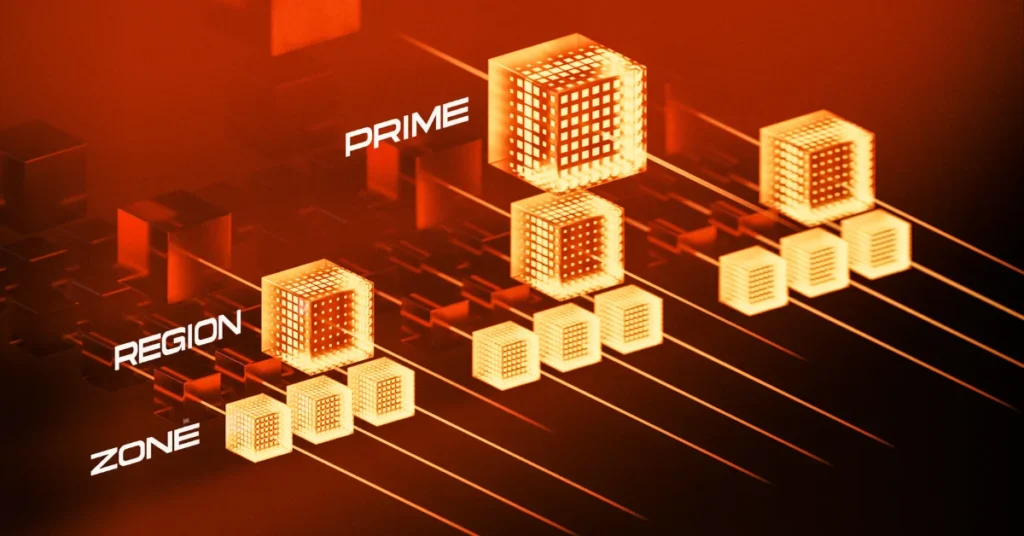

Multi-Threaded Blockchain

This network consists of multiple merge mined chains that work a single single, unified system with shared security, ensuring efficient operation. It is this system that separates local and global data consistency, providing room for parallel transaction processing.

Dynamic Sharding

The use of shards is an important factor to help when the transaction demand greatly increases. In general, Quai Protol autonomously scales based on various factors like uncle block rate and gas limits, ensuring optimal performance.

Dynamic sharding means the creation of new region chains, and their respective zones all seamlessly linked to the network’s consensus. Moreover, the already existing region chains receive an additional subordinate zone, enhancing scalability without disrupting network stability.

Structured Subnets

The network leverages self-organizing subnets to create a low-latency, optimized topology. This structured approach reduces broadcast delays, allowing for faster transaction propagation and significantly improving overall network performance.

Quai Network: Home for Developers

Aside from the monetary system, Quai boasts the ability to host smart contracts hence enabling the building of decentralized applications. On top of supporting smart contracts, the Quai Network brings a world of features that make it a true home for Dapps. The features include:

- The adaptive network with top scalability ensures high throughput

- Opportunities for developers to test their skills and earn rewards

- Sharding also ensures parallelized execution, boosting efficiency

- Quai employs work-enabled primitives to mitigate Miner Extractable Value (MEV), securing fair and decentralized transactions.

- Due to the implementation of a futuristic consensus mechanism PoEM, Quai is a future-proof blockchain-proof blockchain.

Quai Network: The Tokenomics

At the heart of the Quai Network is a dual token system made up of Quai and Qi tokens. There is a stark contrast between the functions of the two tokens.

Quai Token

$QUAI (pronounced “k-why”) is the EVM-compatible, deflationary token of the network. It is designed to be deflationary, hence a proper store of value. In essence, the value of $QUAItoken will change depending on the forces of supply and demand, and market attraction.

$QUAI token is deflationary. As such, the network intends to ensure the inflation rates of Quai still remain below the natural growth rate of the network.

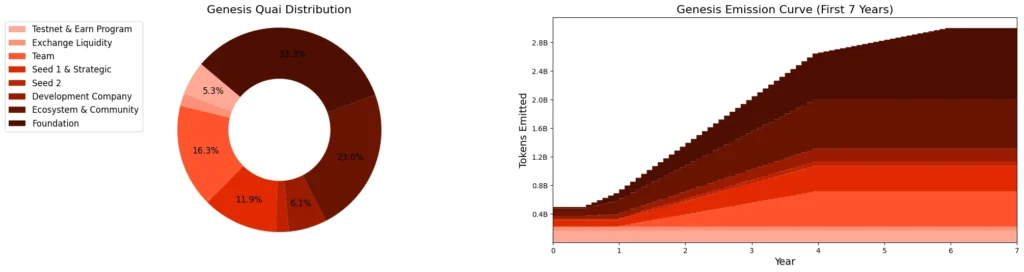

The Quai network has not input any total maximum token supply. Instead, they have a formula that helps determine the supply.

However, the network has a preset amount of tokens to be released during the genesis emission. Moreover, it has determined the allocation of the token to be as follows:

- 33% to Foundation. The foundation is designed to help maximize the adoption of the entire network. 2% of the tokens were released during the TGE, with the remaining released monthly to fund partnerships, adoption and innovation.

- 23% to Community incentives. These tokens will help reward the community for their active participation. 15% of these tokens were released during the TGE with the rest being released in a 42 month duration.

- 16% as rewards to talented team members.

- 14% to Investment rounds. To secure investment for development and growth, Quai Network will issue 14% of its token supply to investment rounds. There will be 3 rounds, 10%, 2% and 2% respectively.

- 6% to the Development company. 25% of the tokens released at TGE, with the remaining coming monthly for 42 months. The point is to help fund the ongoing developments of the protocol.

- 5% to the Testnet and earn program. To help incentivise the community to actively participate in the testnet, the network will make 5% of the tokens wholly available at TFE. This will help ensure the network is thoroughly tested.

- 2% to exchange liquidity. At the TGE, 2% of the tokens will be available on crypto exchanges to help bolster liquidity.

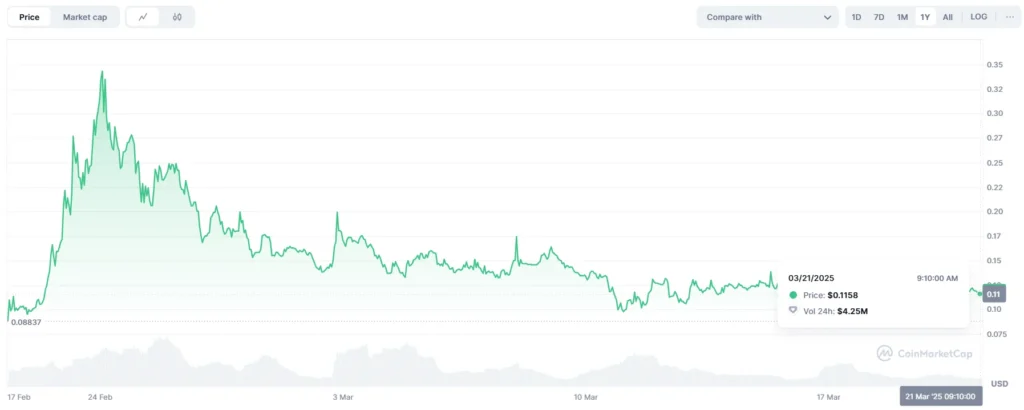

The Quai token is already trading in the markets as of March 20th when writing this report. This token was listed on Coinmarketcap on February 23rd, at merely $0.0883. Quai almost immediately gained value impeccably, hitting highs at $0.357. THe current price of the

Qi Token

On the contrary, Qi (pronounced “chee”) is the energy linked stablecoin. It is the primary reason the entire Quai Network actually exists. It possesses cash like properties, including maintaining value. As such, it can be used as a measure of value, and medium of exchange.

When merged together, the two tokens achieve the utmost qualities of a decentralized global monetary system, i.e., store-of-value, unit-of-account, and medium-of-exchange.

Quai Network: The Decentralized Ecosystem

The Quai ecosystem consists of a large number of projects, all designed to usher us into a decentralized future. Among them include:

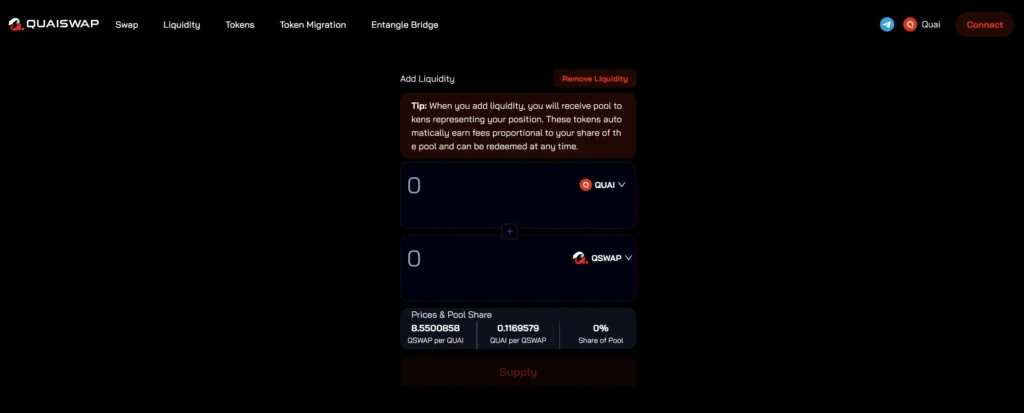

- Exchanges like IcecreamSwap, QuaiSwap, and Portal Finance

- DAOs like Qfan.

- Gaming projects like Qfan, Quai Penguins, and QowBoy

- NFT projects like QuaiClub, Nova Sofi, Qfan, QuaiMark, Margin Ex, Quai Miners, Quai Penguins and Quai Name Service.

- Infrastructure projects like Kryptex Pool, Akash Network, Clore.ai, Alpha Pool, and more.

- Marketplaces like Vast.ai, MarginEx, Poop.fun and others

- Wallets like Koala and Pelagus

Quai Network: The Partnerships

The Quai Network has made a good number of collaborations to enable future growth. Among the primary partners of the network include:

- Polychain Capital — Polychain Capital is a network which was founded in 2016 by Olaf-Carlson Wee, and thrives as an industry leader in crypto focused VC

- Zero1 Capital — Like Polychain, this network thrives as a leader in the crypto VC business.

- Alumni Ventures — Born sometime in 2014, Alumni Ventures also stands among the most active Venture capitals in the globe.

How can you participate and earn $QUAI token?

No matter your expertise, Quai Network offers ways to participate:

- GPU Miners: You can begin mining on Quai and earn rewards in the process.

- Developers: You can also create blockchain-based Dapps, or even participate on dev bounties to earn rewards.

- Run a Node: Take an active role in the network with the Node Wrangler Program.

- Join the Community: Follow us on Twitter and engage with our Discord community.

Final Word

Our guide has gone deep into the world of blockchain technology, specifically focusing on the Quai Blockchain. The Quai blockchain is well known for its ability to fuse energy and money. This network, as already discussed, is bringing a super scalable, energy-based stablecoin.

The implementation of PoEM consensus, multi-threaded blockchain, dynamic sharding and more make Quai a great option for developers and general stakeholders.

FAQs

You can start mining QUAI using your GPU. The network rewards miners for helping secure the system.

As of March 2025, QUAI trades on exchanges like MEXC, Gate.io, CoinEx. The current price of $QUAI token is $0.11.

Yes! Quai has offered airdrops to testnet participants and community members. Follow their socials for upcoming potential airdrops.