The world of decentralized exchanges has been thriving ever since the birth of Uniswap some years back. When writing this report, there were at least 160 decentralized exchange platforms across the vast crypto ecosystem.

However, most of these exchanges thrive by providing a similar type of decentralized trading solutions.

Osmosis, a Cosmos-based decentralized exchange network, dawned on a mission to redefine the role of a Decentralized exchange.

What is The Osmosis Network?

If you are freshly joining the ride into the crypto realm, you desperately need a good decentralized exchange service provider. Today, this guide looks into the power of Osmosis.

Osmosis is the ultimate automated market maker protocol for the Cosmos ecosystem. It received enormous praise for being the first AMM protocol within the Cosmos ecosystem.

But first, what is an AMM?

An AMM, or in full, Automated market maker, is simply a DEX protocol relying on unique algorithms to define the price of assets in liquidity pools, hence acting as a centralized market maker.

Now, back to Osmosis.

The Osmosis Automated Market Maker protocol was created explicitly for Cosmos but aims to expand further to other blockchain networks. Osmosis is a decentralized exchange network that nurtures a highly interoperable cross-chain trading experience.

Osmosis provides users with the ability to create custom AMM with independent liquidity pools. Participants enjoy the freedom to launch liquidity pools with other unique features, including bonding pools.

When writing this report, Osmosis was the epitome of DEX services within the Cosmos ecosystem, taking approximately 40% of inter-blockchain transfers.

Osmosis is a proof-of-stake blockchain network running a DEX for IBC-compatible chains.

Who is Behind the Osmosis Network?

So, who created the Osmosis Network?

Born in June 2021, Osmosis was created by a collaboration between 2 core Cosmos teams. The first team consists of Sunny Aggarwal and Dev Ojha. The second team consists of Josh Lee and Tony Yun, who worked at Interchange Wallet and Kepir.

All the co-founders have robust education and experience dealing with blockchain-focused projects.

- John Lee, for instance, worked at Tendermint and Lunamint.

- On the other hand, Sunny Aggarwal was a research scientist for Tendermint.

The Investors?

Over the years, Osmosis Foundation has garnered backing from several top investors, including Paradigm, Charlie Noyes, Robot Ventures, Terraform Labs and Nascent.

Moreover, Osmosis has enjoyed partnerships with the Cosmos Ecosystem, including Evmos, Sifchain, Juno, and Konstellation.

The Background Information!

Most DEX platforms in the crypto landscape, including the likes of PancakeSwap, UniSwap and SushiSwap, thrive at providing top-tier trading solutions for DeFI-focused assets.

However, most AMMs only operate within their home blockchain, limiting the circulation of the assets within the native chain. Of course, there are workarounds like bridges — but they are not as efficient and secure.

Moreover, the features of AMM are nary flexible, leaving no room for flexibility. For instance, developers can’t alter parameters like token weights and swap fees in many networks.

Yes, some DEXes like UniSwap V3 enable participants to create their liquidity pools with fee sizes ranging between 0.3% and 1%. However, even while such platforms afford flexibility in one area, they lack in others.

It is this problem that Osmosis aims to eradicate. Its feature-rich solutions afford every investor more flexibility while ensuring no cross-chain limitations. For instance, investors can transfer assets across the tens of blockchains linked to Cosmos SDK.

What are The Key Features of Osmosis?

Osmosis Network’s core functionality as a revolutionary automated market maker leverages many top features. Here are the features distinguishing Osmosis from its other peers;

Cross-chain AMM powered by IBC

Before Osmosis, no AMM network was operating on the Cosmos ecosystem.

Through the power of Cosmos’ own IBC tool, Osmosis can access all native assets within the Cosmos network and zones. This creates a financial flow within the Cosmos Ecosystem.

The cross-chain capability is for more than just Cosmos-based assets. This IBC protocol’s capability extends to non-IBC platforms like Ethereum-based ERC-20 tokens, Bitcoin-like chains, BNB chains and many other L1 and L2s.

Customizable Curves, Fees, and Other Parameters

Secondly, Osmosis pioneered the customization factor onto its AMM to bolster functional efficiency. This is in total contrast to most traditional AMMs, which lack customization options for investors.

In Osmosis, users can customize key factors like swap fees and token weights for every available liquidity pool. Moreover, it implants the curve method and Twap calculation.

This flexibility allows users to create new curves leveraging temporal dependencies, volatility indexes, and off-chain oracles.

Self-governing Liquidity Pools

What about the liquidity pool governance? Well, all liquidity pools afforded by Osmosis are self-governing.

Within the Osmosis protocol, users are given the chance to vote on various proposals of change. Among the changes of these protocols could include swap fees, rewards, incentives, curve algorithms, and TWAP calculations. As a result, the liquidity providers earn the prime authority in the platform’s decision-making.

Osmosis allows these tools to govern themselves more flexibly by providing community governance for liquidity pools.

Rewards for Liquidity Providers

Osmosis incentivizes Liquidity providers for their readiness to provide liquidity in the pools continually. The rewards take the shape of the platform’s native tokens, OSMO.

Osmosis encourages third parties to contribute incentives to liquidity pools using Osmosis’ ‘incentive module’. This module favours liquidity providers who lock their LP tokens for extended periods, thereby reducing the volatility of liquidity pools.

Superfluid Staking

Superfluid staking is a feature that appeared first in the crypto universe through Osmosis DEX. This type of staking combines where users stake assets while also providing liquidity to pools. In essence, this system offers an opportunity for a dual reward system, where users earn both staking rewards and transaction fees from pools.

MEV Resistance via Private Mempools

Osmosis ensures resistance against Maximal Extractable Value (MEV) techniques, such as ‘sandwiching’, by using threshold encryption to maintain the privacy of its transaction pool (mempool). This prevents malicious actors from spotting and exploiting favourable trade opportunities.

The OSMO Token

Native within the Osmosis network is a native token named OSMO. OSMO is the most essential part of the Osmosis network, enabling transfers and governance. Here are the roles of OSMO explained:

- Utility — The token is primarily used as a utility asset within the Osmosis network. In essence, OSMO helps pay fees within the Osmosis decentralized exchange.

- Governance – The entire governance system of the Osmosis network hugely relies on the power of the OSMO token. Token holders can participate in the network’s decision-making through voting. This makes Osmosis a highly decentralized network.

- Staking — You can stake the token to stand a chance of earning even more tokens. Furthermore, by staking OSMO, you can get future airdrop tokens.

- Exchanges — The token is also available for trading on popular cryptocurrency exchanges. You can buy, hold and sell to gain.

- Incentive — You can also provide liquidity in the Osmosis pool to stand a chance of earning incentives.

The Osmosis Network caps the total supply of OSMO at 1 billion tokens—the current supply circulating stands at 492 million.

OSMO Token Price Action and Prediction

When writing this report in Early 2024, OSMO traded at a mere $1.6. This, of course, is way lower than OSMO’s all-time high, which stands at $10.9. OSMO’s all-time high was achieved in its last bull run in April 2022.

By October 2023, OSMO had plunged to a low of $0.22. However, after hitting its all-time low, OSMO immediately began a recovery, getting to a high of $1.88 by Jan 2024.

With the impending bull run, there is a high hope that OSMO will reclaim its all-time high. Imagine OSMO soaring to the $10.9 mark.

However, there is a considerable possibility that Osmosis will gain more use cases with the blooming Cosmos ecosystem in the coming months. The birth of tokens like DYM, ALT and TIA within Cosmos gives Osmosis a broader market base.

As such, investors could see OSMO 10x or even 20x in the coming bull run. This puts OSMO among the must-have tokens for the upcoming bull season.

How To Buy OSMO

Well, with the growth potential of OSMO, investors must start purchasing from now on. But the big question is, where can you buy OSMO tokens?

Here are significant marketplaces where you can purchase this coin:

- Binance — The largest crypto exchange network also has the highest trading volumes of OSMO tokens. The exchange primarily supports the OSMO/USDT and OSMO/BTC pairs.

- Osmosis – The DEX network supporting the most OSMO pairs is Osmosis. The supported pairs include USDC/OSMO, TIA/OSMO, AKT/OSMO, ATOM/OSMO, axlUSDC/OSMO, ETH/OSMO, AXL/OSMO, DYM/OSMO and more.

- Coinbase also supports the OSMO/USD market

Other exchanges include KuCoin, HTX, Bitmart, MEXC, Gate.io, Bitget and BingX.

The Osmosis Ecosystem

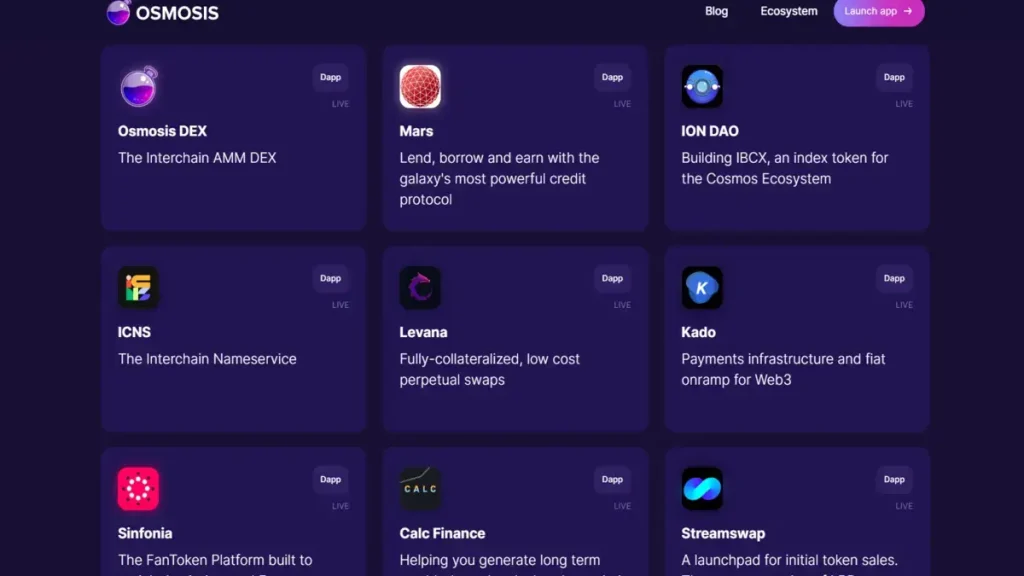

The Osmosis network comprises a vast ecosystem of products and services that are hugely beneficial to the average OSMO user. Among the parts of the ecosystem include:

- Dexmos.app — The analytics tool for Osmosis

- Restake.app — This is a tool designed to allow Osmosis validators to auto-compound your Osmosis stakings.

- Skip — This is a building platform designed for MEV products on Osmosis.

- Namada — This is essentially a privacy blockchain enabling blockchain swaps.

Other products include Membrane, Interchain Info, Zodiac, Cron Cat, Babylon, 4K, Pyth, Saage, Defund, Phase and Autonomy.

Conclusion

This guide explored the realm of Cosmos, specifically the decentralized exchange service provider Osmosis. The platform based on Cosmos thrives by providing top-tier cross-chain DEX services to its community.

The upcoming 2024 bull season and the growing Cosmos community could really drive OSMO tokens to super high prices.