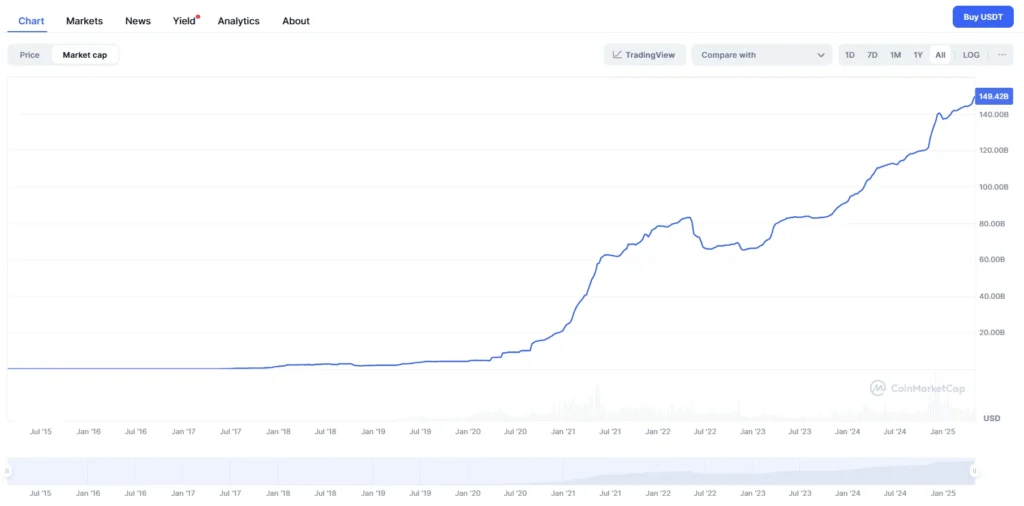

As of May 2025, Tether had a market cap of around $159 billion, positioning itself ahead of all other stablecoins. However, the journey has been challenging for this stablecoin.

Today, we will be looking into the world of USDT.

What is Tether (USDT)?

Tether is the largest stablecoin. But what is a stablecoin?

A stablecoin is a class of crypto assets designed as a hedge against crypto volatility. They attain this by maintaining a peg to a fiat currency, a physical asset or other crypto assets.

At launch, its primary purpose was to address the volatility of crypto markets. Moreover, Tether aimed to offer stability and liquidity in crypto, bringing a more accessible channel to convert digital currencies and use them in everyday transactions. The vision of its development was to create a digital currency paired with traditional fiat assets, hence bringing a stable medium for transactions.

History and Development of Tether

Launched in 2014, the crypto market’s behemoth, was named Realcoin at its birth. It is the brainchild of Brock Pierce, Reeve Collins, and Craig Sellars.

As per reports, the first tokens associated with Tether were issued on the Bitcoin blockchain sometime on October 6, 2014, using the Omni Layer Protocol.

However, over time, Tether grew beyond Bitcoin and began supporting blockchains like Ethereum, Tron, EOS, Binance Smart Chain, and many more. The more it was adopted, the more it became a reliable bridge between fiat and cryptos.

Key Milestones in Tether’s History

Having existed for nearly a decade, USDT has achieved much within the crypto realm. Here are some of the project’s major milestones:

- Launched in October 2014 on Bitcoin by the operators of Bitfinex.

- Tether was first used in crypto exchange networks in 2015, issuing about 700K more tokens. By the end of 2015, around 950K USDT tokens were in circulation.

- By the end of 2016, around 6 million USDT were in circulation.

- In 2017, there was some drama around Tether as Bitfinex and Wells Fargo ended their relationship. The latter denied Bitfinex access to several major Taiwanese banks. The Tether depegged to $0.91 owing to this drama.

- Later, in September 2023, an independent auditor, Fried LLP, released a report detailing that cash reserves fully backed the amount of Tether circulating at the time.

- November 2017 is when the hidden relationship between Tether and Bitfinex was revealed.

- November 2017 – Tether hacked.

- Owing to lots of controversies, the price of Tether depegged again in October 2018 to about $0.85.

- Tether’s General Consul released a report detailing that the amount of USDT circulating was only 74% backed by USD reserves.

How Tether Works

First, we must understand the stablecoin’s pegging mechanism and how it functions. It maintains a 1:1 peg with USDT by ensuring that an equivalent value of USD completely backs each token in reserve. In essence, every USDT in circulation has a backing of 1 USD in Tethers reserves.

So, what is the issuance process associated with Tether? Here are the steps:

- Foremost, as the demand for USDT increases, the issuer pre-issues large batches of the token to meet the demand. These pre-issued tokens are also known as authorized tokens.

- The tokens are then distributed to the community in large batches.

- At the point of actual issuance, the issuer has already deposited an amount equivalent to the USDT in circulation.

- The redemption process. In essence, you can redeem your USDT for USD at any time. On redemption, the redeemed tokens are erased from circulation.

The reserves are designed to help maintain the price stability of USDT in the markets. They are, in other words, some form of collateral.

Tether’s Impact on the Cryptocurrency Market

So, the big question is, what is the general impact of Tether USDT in the general cryptocurrency markets? Tether has a multifaceted impact on the crypto markets, affecting investors and traders alike.

Here are some critical functions associated with Tether within the crypto realm:

- Stablecoin Anchor: Compared to cryptos like Bitcoin and Ethereum, USDT stands out as highly stable owing to its dollar peg. As such, Tether can guarantee price stability to average users.

- Liquidity Bridge: Secondly, USDT was created to facilitate a seamless money flow between cryptocurrencies and traditional fiat currencies. Its high liquidity, with over 100B coins circulating, is key for crypto transactions.

- Payments: Tether is used for payments. Some online merchants have been accepting payments in USDT due to price stability.

- Crypto Trading: Tether has become a popular asset in crypto trading, with many crypto exchanges relying on the asset. Tether’s massive liquidity allows traders to move between positions with utmost ease.

- Blockchain Integration: As a cryptocurrency, USDT leverages blockchain technology for efficient token transfers, bridging the gap between crypto assets and fiat stability.

Tether allows traders and investors to enjoy benefits such as portfolio diversification and risk mitigation.

Controversies Connected to Tether

Tether, the stablecoin pegged to the US Dollar, has faced a series of controversies and challenges since its inception:

Transparency and Reserve Backing

One of the most significant controversies associated with USDT is about reserve backing. Over the years, there have been questions about whether Tether’s reserves fully back the USDT in circulation. And Tether’s lack of transparency has yet to fuel the speculations and questions.

As per many, USDT has only sometimes openly demonstrated that they hold enough USD to back the circulating supply. Tether Limited does not regularly produce official details of audits of its reserves.

Earlier this year, analysts at JPMorgan cautioned against Tether’s dominance, explaining that the network lacks “regulatory compliance and transparency.”

The analysts explained that USDT needs to improve in terms of transparency when compared to its biggest competitor, USDC.

Legal Scrutiny

Secondly, legal scrutiny. The USDT issuer has been under serious legal scrutiny in the past few years. In 2021, the US Commodities and Futures Trading Commission alleged that Tether made misleading claims of having enough reserves to back each of the coins in circulation.

There were also reports alleging that, according to Dune Analytics data, Tether has failed to blacklist accounts associated with Tornado Cash, a network sanctioned in the US.

Later, USDT fell under the New York Attorney General’s watchful eyes for hiding major losses. The AG highlighted that the USDT issuer actually lacked access to global banks since mid-2017. The Tether issuer settled the two investigations with the watchdogs without necessarily admitting any liability.

Market Manipulation Allegations

Another allegation on Tether is that the stablecoin was used to manipulate crypto markets. According to researchers and analysts, a large number of unbaked USDT tokens were issued sometime in late 2017 to buy BTC, hence causing price pumps.

Use in Illicit Activities

There have been questions on Tether’s use in illegal activities. For instance, Tether is increasingly gaining favour from money launderers and fraudsters in Southeast Asia.

As per the UN, Tether’s stability, anonymity, low transaction fees, and ease of use have been the primary drivers behind the increased use in illegal activities.

Amidst all these controversies and challenges, Tether still thrives in the crypto realm owing to its liquidity and high adoption in crypto.

Future Prospects of Tether

In the recent past, Tether has been expanding its focus from only stablecoins to the wider technological universe. For instance, one of the most notable developments in 2024 is the establishment of an AI Unit.

The Tether network has already begun actively recruiting top-tier talents for AI innovation.

As per reports, Tether’s AI developments aim to focus on some key areas, including the development of open-source, multimodal AI models. This will really redefine the standards of the AI industry while leading to innovation.

Moreover, USDT will lead some collaborations designed to integrate AI solutions and address real-world challenges. Finally, USDT intends to expand the realm of open AI widely through innovative community-driven projects.

The AI developments announced by Tether in March 2024 will actually be the focus of Tether’s prospects.

Conclusion

Of course, Tether indeed plays a significant role in the realm of crypto assets. Acting as the stablecoin anchor and go-to asset for price stability, USDT is truly a great player in the realm of crypto assets.

The guide has also highlighted the various challenges associated with Tether, including questions about transparency about reserve backing. However, the criticism has not been able to stop Tether.

In the coming years, Tether will continue to gain more use in the crypto realm. There is a huge possibility that Tether will reach a $1 trillion market cap in the future.