NFTs, or non-fungible tokens, are cryptographic special tokens associated with both digital and real content that serve as identification of group membership, ownership, and authenticity. NFTs give Gamers the freedom to exchange or sell the exclusive digital items they buy in games, such as starships or pet monsters, making them feel like true owners. Data obtained from the NFT research website, CryptoSlam, shows that the worldwide NFT market recorded sales of approximately $333 million in October 2022. DappRadar, a well-known website for tracking NFT statistics, also keeps tabs on the decentralized application market and Blue Chip NFTs. The NFT business has expanded into other domains by redefining the value provided to digital assets.

What are Blue Chip NFTs?

Similar to blue chip stocks, blue chip NFTs are digital assets with a high value and minimal risk. In the stock market, the phrase “blue chip” was first applied to significant market capitalization stocks, which are regarded as the foundation of the market. Shares of a reputable company that has been in business for a while are referred to as “blue chip stocks” because of their track record of consistency, stability, and reliability. Historically, these blue-chip assets have proven to be resilient to market downturns.

Blue chip NFTs, on the other hand, are NFTs with a history of price stability as well as expansion that are regarded as high value and minimal risk. These NFTs have become well-known and well-liked among investors and collectors, positioning them as stars in the industries they serve.

What qualifies as a blue-chip NFT collection?

Certain NFT collections have demonstrated more consistency, despite the fact that the NFT market isn’t particularly old and that everything moves so quickly. These investments are blue-chipped in this case because, as we all know, they are incredibly secure in a highly turbulent industry.

But what, precisely, qualifies as blue-chip? Analyze the following few criteria:

- The project’s staff is well-established in the sector.

- The blue-chip NFT holdings offer a long-term worth proposition.

- The tokens have a demonstrated use case that goes beyond imagination.

- A strong community has been established around them.

Features of Blue Chip NFTs:

There are multiple factors that contribute to an NFT’s ‘blue-chip’ classification. This word is frequently used to refer to a more comprehensive assessment of long-term value that is typically based on variables like:

Historical Significance:

Blue chip NFTs’ historical worth is one of its primary characteristics. This is a reference to the NFT’s floor pricing and sales volume. An NFT needs to have a track record of steady value growth in order to be classified as a blue chip. Furthermore, it must have a strong level of demand with a significant sales volume. Additionally, these initiatives usually have an extensive valuation, which highlights the project’s worth.

Brand Influence:

Brand power is the second characteristic of blue chip NFTs. They are thought to be worth more since they are frequently linked to well-known brands or celebrity endorsements. An NFT belonging to a series that features a well-known musician or artist, such as Justin Bieber, among its holders, for instance, is much more likely to be regarded as a blue chip NFT compared to that owned by the typical person. The NFT gains legitimacy and reputation from its affiliation with a well-known brand, which draws in more investors and buyers.

The Unit:

An NFT’s team is a major factor in deciding its rank as well. The founders, developers, and advisors of a blue chip NFT frequently have a solid industry reputation and track record. This suggests that a group of professionals with the know-how to guarantee the NFT’s success is supporting it.

Plan of Action:

Another crucial feature to take into account is the plan of a blue chip NFT. The NFT needs to have a distinct and useful purpose, such being able to access exclusive events, unlock exclusive material, or join exclusive communities. Along with showing a promising future, the NFT needs to have a strong use case and a road to success that is well-defined with detailed plans for getting there.

Community Organization:

One of the most important factors in determining an NFT community’s blue-chip status is its vibrancy. It is enhanced by a powerful and engaged group of supporters, sponsors, and enthusiasts. As an evangelist, this network expands its reach and accelerates its growth.

Techniques for spotting blue-chip NFTs

Blue-chip NFTs can be located by investigating well-known platforms, following influencers, monitoring well-known artists and collaborations, and taking demand and rarity into account.

The following is a quick summary of the methods used for discovering blue-chip NFTs:

Analyze Reputable Platforms:

Start with well-known NFT platforms like NBA Top Shot, Rarible, SuperRare, and OpenSea. These platforms frequently have a large selection of high-quality NFTs made by well-known corporations, celebrities, and artists.

Engage with Influencers and NFT Experts:

Stay up to date with the NFT industry through engagement with collectors, experts, and influencers. Blue-chip NFTs are discussed. Participate in NFT forums, groups, and social media pages.

Demand and Limited Supplies:

Limited editions, unique artwork, historical significance, or collector demand are common characteristics of blue-chip NFTs. Concentrate on unique, limited-edition, or culturally noteworthy NFTs. Examine NFT collections’ track record and performance prior to classifying them as blue-chip assets.

It is essential to remember that the NFT market is volatile and that what people presently regard as a blue-chip NFT may not remain so over time. Do your homework, keep up to date, and assess demand and market trends before making an investment.

Interacting with NFT communities:

Engaging in NFT networks and keeping up with influential individuals can yield valuable information, first access to opportunities, the latest trends, and potential blue-chip NFTs.

Attending Drops and Auctions:

Bidding or participating in auctions of NFT and drops can result in the acquisition of blue-chip NFTS at the time of release.

Analyzing Past Information:

You can make well-informed decisions on the history, rarity, and potential value growth of individual NFTs by researching past sales, market patterns, and the financial performance of certain NFT collections.

How to make investments in blue-chip NFTs?

Due to their high demand and exclusive use in the NFT market, blue-chip NFT assets have an opportunity to grow in value. These assets have historically attracted the interest of investors and collectors.

This is a detailed guide for how to buy these assets:

- Learn about the NFT industry and be up to date on the newest trends and advancements in the NFT field.

- Look at reliable NFT projects and platforms that have hosted prestigious NFTs in the past.

- For your NFT investments, establish a budget that fits your risk-return profile.

- Select a cryptocurrency wallet (like MetaMask, Trust Wallet, or Ledger Wallet) that is compatible with NFTs.

- Make a user account on a trustworthy NFT website. Learn about the features, interface, and any costs related to the platform.

- Make thorough research on reputable NFTs that draw your interest. Look for qualities that provide value, such unique features or limited availability.

- Follow the on-screen steps to complete the purchase by linking your wallet, bidding or purchasing the NFT at the suggested price, and completing the transaction.

- Move your earned NFTs into your wallet and keep them safe.

- Keep up with market developments and modify your approach as necessary.

Top blue-chip NFT Collections

After learning how to recognize blue-chip NFT collections, it’s time to get to know ourselves with some of the most well-known projects in the industry. Here are a few projects you should know about:

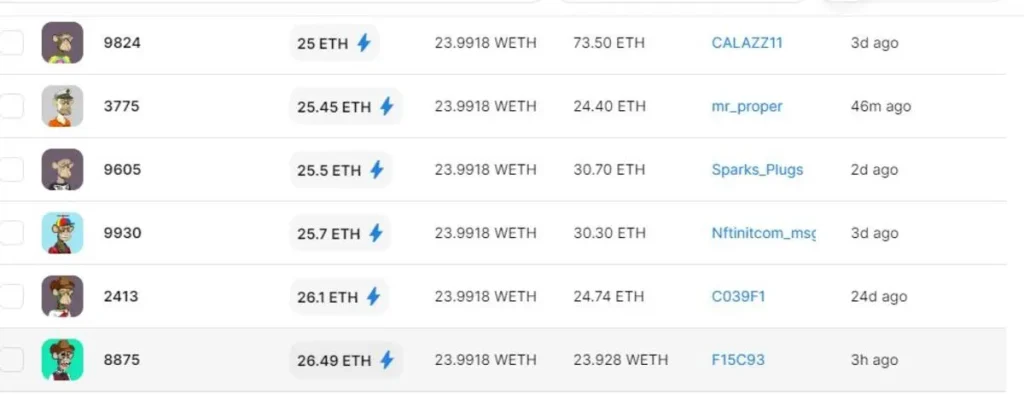

Bored Ape Yacht Club

Yuga Labs created the 10,000 profile photos that make up the Bored Ape Yacht Club (BAYC), an NFT collection on the blockchain of Ethereum. Collectors of BAYC own artwork featuring indifferent apes with ornaments and attributes that are randomly produced. In addition, the apes differ from one another due to their distinct personalities. With volume sales of about $1.57 billion in 2022, BAYC emerged as the top-selling NFT collection. Some celebrities who own Bored Apes include Shaquille O’Neal and bands like Madonna and Eminem.

CryptoPunks

One of the first NFT collections was created by Larva Labs and is called CryptoPunks (PUNK). PUNK is an Ethereum-generated collection of 10,000 photos that draw inspiration from the punk movement in London. There are 3,840 female punks and 6,039 male punks in all. 286 have 3-D glasses, 303 have muttonchops, while 696 punks sport hot lipstick. One of the holders of CryptoPunks is DJ Steve Aoki, who is working with 3LAU, another PUNK holder, on a conceptual music/art project that draws inspiration from CryptoPunks.

Azuki

Azuki (AZUKI) NFT is a set of 10,000 generative anime-style avatar NFTs. The collection, which was created with the ERC-721 standard, was one of the most well-liked NFT collections. Distinctive characteristics, including hair, attire, history, skills, and equipment like skateboards and swords, set apart the ten thousand Azuki NFTs. The “Spirit” type of Azuki NFTs, which make up 0.97% of the whole collection, are the most valuable. According to OpenSea’s all-time trading volume, Azuki was among the top five NFTs. Azuki generated around $850 million in revenue in 2022.

CloneX

With the first NFT avatar set that is easily transportable, CloneX (CLONEX) gives users the ability to use 3D files that are compatible with various platforms. Japanese designer Takashi Murakami and digital shoe maker RTFKT collaborated on the collection’s design. CloneX is more than just a metaverse-capable platform with premium avatars; it’s the beginning of a community-driven environment that prioritizes excellence. The CloneX NFTs are extremely valuable and scarce, which is why their makers created them so rapidly sold out. In the previous year, CloneX’s sales volume reached $600.5M.

Final Words:

They are highly valuable and popular. They are known for their historical significance and brand power. Their team strength, usability, and strong collector and fan base contribute to their value. These NFTs are scarce and collectible. They grant access to private communities and events. This makes them highly valued digital assets. If you’re considering NFT investments, blue chip efforts are a great starting point. They stand out due to their excellent track records. They also have substantial sales volumes. Their communities are highly engaged. This keeps them among the most desirable and popular digital assets.