Imagine you’re walking a tightrope between skyscrapers, with your life savings in a backpack. That’s what crypto trading feels like without proper risk management. Just as a safety net protects tightrope walkers, risk management strategies shield crypto traders from potential disasters.

In the volatile world of cryptocurrency, where prices can swing wildly in minutes, effective risk management is crucial. A recent study shows that 95% of day traders lose money in the crypto market, highlighting the importance of solid techniques. The cryptocurrency market has grown from a $1.6 billion market cap in 2013 to a peak of $2.9 trillion in 2021, emphasizing both opportunities and risks. Let’s explore how risk management can protect your digital wealth.

Understanding Crypto Risk Management

Risk management in crypto trading involves strategies to minimize potential losses while maximizing profits. It’s a critical aspect that helps traders navigate the highly volatile market. Effective risk management protects from financial setbacks and emotional distress.

Key Components of Risk Management in Crypto:

- Understanding Market Volatility

- Setting Clear Goals and Limits

- Diversification Strategies

- Risk-Reward Ratio Analysis

- Proper Position Sizing

Understanding Market Volatility

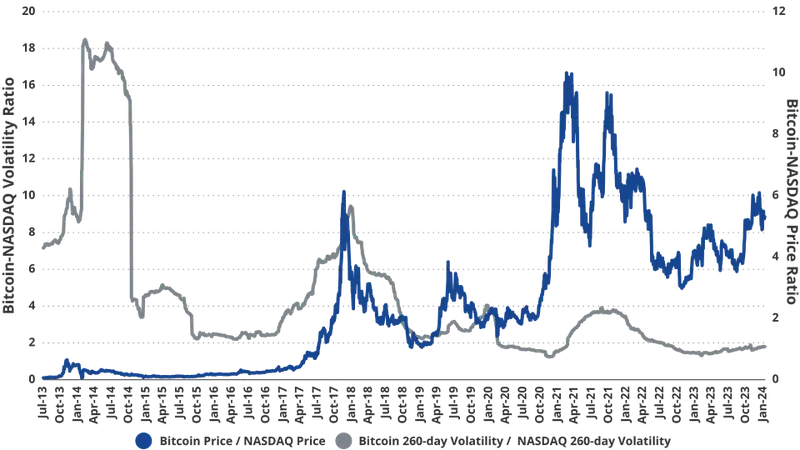

Crypto markets are notorious for extreme price fluctuations. Bitcoin’s annualized volatility has decreased from 165% in 2011 to 60% in 2023, but it’s still significantly higher than traditional assets. Preparing for this volatility is key to successful trading.

Tips to Manage Volatility:

- Study historical price movements.

- Use technical analysis tools.

- Stay informed about market news and trends.

- Understand the factors that influence crypto prices.

Setting Clear Goals and Limits

Successful traders define profit targets and acceptable losses. For example, Bitcoin has experienced a 94% drop in 2011 and an 84% decline from 2017 to 2018. By setting goals, traders avoid emotional decisions and adhere to their strategy.

Factors to Consider:

- Overall investment strategy.

- Risk tolerance.

- Time horizon.

- Desired return on investment (ROI).

Diversification Strategies

Spreading investments across different cryptocurrencies reduces risks associated with individual assets. While Bitcoin’s dominance dropped from 94% in 2013 to 50% in 2023, diversification has become essential.

Effective Diversification Includes:

- Investing in large-cap, mid-cap, and small-cap coins.

- Exploring blockchain projects and use cases.

- Considering crypto-related stocks or ETFs.

- Balancing crypto with traditional assets.

Risk-Reward Analysis in Crypto Trading

The risk-reward ratio helps traders assess if a trade is worth the risk. To calculate:

- Determine your entry point.

- Set a stop-loss level.

- Identify your profit target.

- Divide potential profit by potential loss.

Tip: Aim for a ratio of 1:2, meaning potential profit is twice the potential loss.

Position Sizing: Optimizing Crypto Risk

Position sizing ensures that no single trade significantly impacts your portfolio. This is vital for long-term sustainability in trading.

Factors to Consider:

- Total portfolio value.

- Risk tolerance.

- Market conditions.

- Cryptocurrency volatility.

Essential Crypto Risk Management Techniques

Stop-Loss Orders

Stop-loss orders automatically sell assets when they hit a predetermined price, limiting losses. This tool is crucial, especially during market downturns.

Take-Profit Orders

Take-profit orders automatically sell assets at a specific price, locking in gains. It helps traders secure profits and avoid holding onto winning positions too long.

Dollar-Cost Averaging (DCA)

DCA involves investing fixed amounts at regular intervals, reducing the impact of market volatility. It’s effective for smoothing out price fluctuations over time.

Hedging Strategies

Hedging protects against losses by taking offsetting positions in related assets. In crypto trading, hedging may involve:

- Short-selling correlated assets.

- Using futures contracts.

- Investing in inverse ETFs.

Portfolio Rebalancing

Regular portfolio adjustments maintain desired risk levels and capitalize on opportunities. Rebalancing aligns your portfolio with risk tolerance and goals.

Emotional Control: Crucial for Crypto Risk Management

Emotional decisions can lead to major losses. Strict risk management protocols help traders stay objective and avoid impulsive actions. Fear and greed often cloud judgment.

Tips for Maintaining Emotional Control:

- Stick to a predefined plan.

- Take breaks when overwhelmed.

- Practice mindfulness techniques.

- Keep a trading journal to track emotions and decisions.

Leveraging Technology for Risk Management

Advanced platforms offer tools to enhance risk management, including real-time data, automated trading algorithms, and risk analysis. As daily trading volumes grew from $1 billion in 2017 to $100 billion in 2023, these tools have become vital.

Key Tools Include:

- Automated trading bots

- Portfolio tracking apps like CoinStats

- Risk assessment software, for example: RiskWatch, Protecht.ERM or MetricStream

- Market sentiment analysis tools.

Staying Informed and Adapting Strategies

The crypto market evolves rapidly, so successful traders continuously adjust their risk management strategies. The regulatory landscape also changes—Japan recognized Bitcoin as legal tender in 2017, and the EU passed comprehensive crypto regulation (MiCA) in 2022.

Ways to Stay Informed:

- Follow reputable crypto news sources.

- Join online trading communities.

- Attend cryptocurrency conferences and webinars.

- Engage with blockchain and crypto experts on social media.

Common Pitfalls in Risk Management

Even experienced traders fall into traps that undermine their strategies.

Key Pitfalls Include:

- Overleveraging.

- Ignoring market sentiment.

- Failing to diversify.

- Neglecting stop-loss orders.

- Chasing losses.

- Underestimating security risks (e.g., $460M Mt. Gox hack in 2014).

Best Practices for Risk Management in Crypto Trading

To wrap up our exploration of risk management in crypto trading, let’s review some best practices that can help traders navigate the volatile cryptocurrency market more safely and effectively.

- Start with a solid understanding of blockchain technology and cryptocurrencies

- Use reputable exchanges and wallets with strong security measures

- Implement two-factor authentication for all accounts

- Keep a trading journal to track performance and identify areas for improvement

- Never invest more than you can afford to lose

- Regularly review and update your risk management strategy

- Consider seeking advice from experienced traders or financial advisors

In conclusion, mastering risk management in crypto trading is like learning to navigate treacherous waters. It requires skill, practice, and constant vigilance. By implementing robust risk management strategies, traders can navigate the unpredictable cryptocurrency market with greater confidence and security. Remember, in the world of crypto trading, proper risk management isn’t just a safety net – it’s your lifeline to long-term success. With 72% of institutional traders citing risk management as their top priority in crypto investments, it’s clear that this aspect of trading is crucial for both novice and experienced investors alike. By following these guidelines and continuously adapting to market changes, you’ll be better equipped to protect your digital assets and potentially reap the rewards of this exciting, albeit risky, financial frontier.

FAQ

Risk management in crypto trading involves strategies to minimize potential losses while maximizing profits. It’s about protecting your investments from the high volatility of the cryptocurrency market.

Key techniques include setting stop-loss orders, diversifying your portfolio, and using proper position sizing. Additionally, never invest more than you can afford to lose.

Diversification spreads your investments across different cryptocurrencies, reducing the impact of poor performance from any single asset. It helps balance your overall risk exposure.

Stick to a predetermined trading plan and avoid making impulsive decisions based on fear or greed. Taking breaks and keeping a trading journal can also help manage emotions.