Coming hot on the heels of the just-released U.S. Consumer Price Index (CPI) data. With inflation numbers meeting expectations at 2.5%, down from the previous 2.9%, we’re seeing a potentially bullish backdrop for crypto. This economic indicator often influences market sentiment.

We’re seeing some exciting developments across various assets. ICP has broken a major long-term trendline, suggesting a potential bullish reversal, while ORDI is on the verge of breaking out from a falling wedge. Check out our technical analysis!

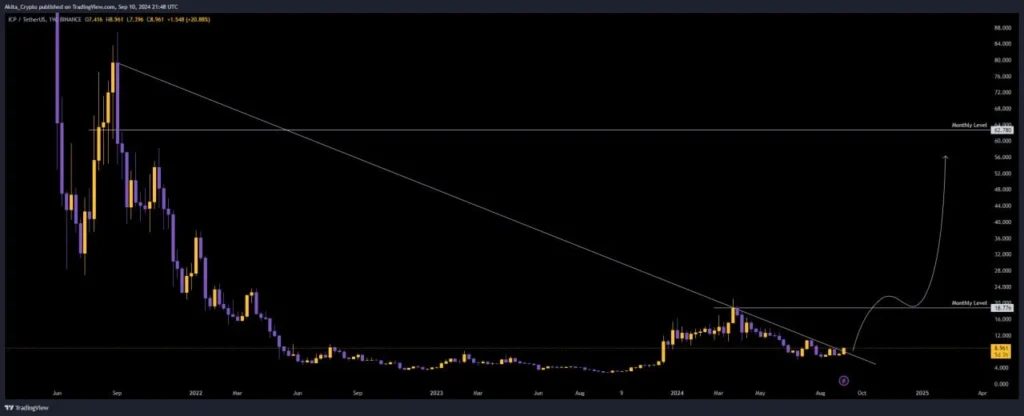

ICP/USDT

ICP is Breaking a Major Long-Term Trendline, which is an indication of trend reversal!

Our Long-Term Target for this Bullrun is the zone 60$ – 80$. We believe this range is achievable given the project’s fundamentals and market potential.

19$ is just a Starter for this Run! We expect to see several key resistance levels tested as the price climbs. Keep a close eye on volume and market sentiment as we progress through this bullish phase.

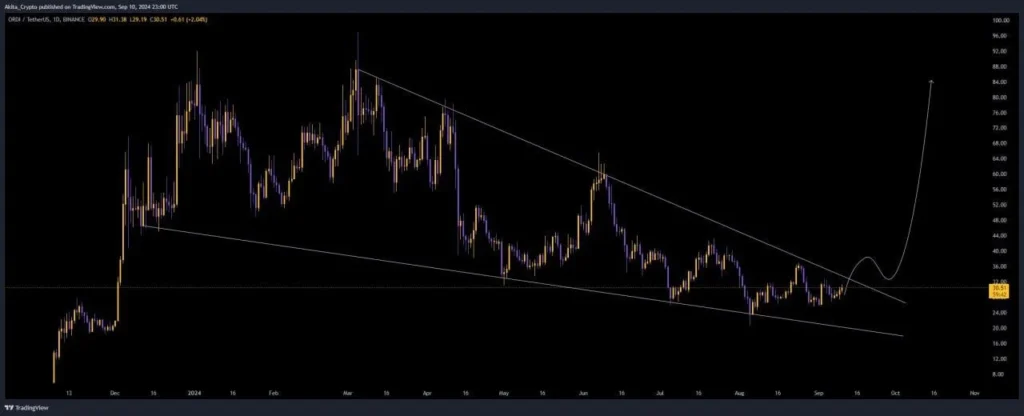

ORDI/USDT

We’re looking for a break out of the falling wedge!

This pattern often signals a potential reversal, and we’re watching closely for confirmation. A successful breakout could lead to significant upside momentum.

FET/USDT

Fetch.ai is Breaking a Major Trendline!

With the hot AI narrative driving market interest, we believe FET can easily reach the 2.8$ level!

We’re seeing strong momentum in AI-related projects, and Fetch.ai’s unique positioning in this space could be a significant catalyst. Keep an eye on overall market sentiment towards AI tokens.

Key resistance levels to watch on the way up. An increased trading volume would further validate this bullish move.

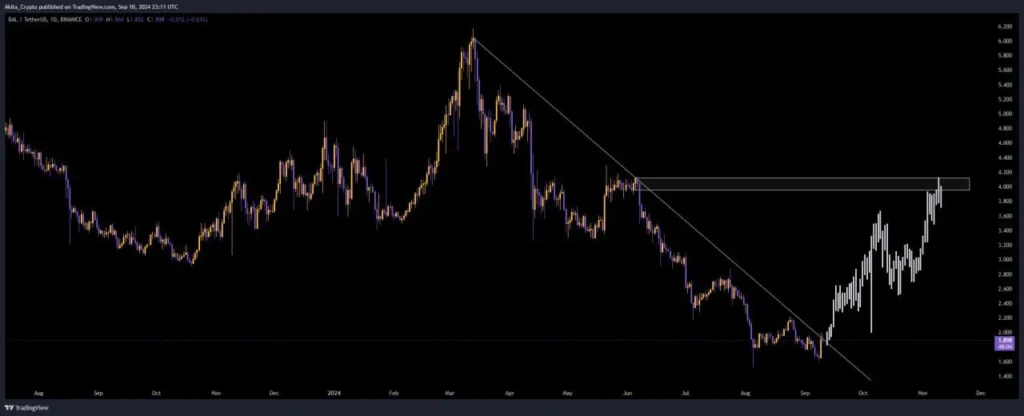

BAL/USDT

Balancer back to 4$ Level!

If BAL can establish solid support at this level, we might see further upside potential. Keep an eye on broader DeFi market trends and any protocol-specific developments that could influence BAL’s trajectory.

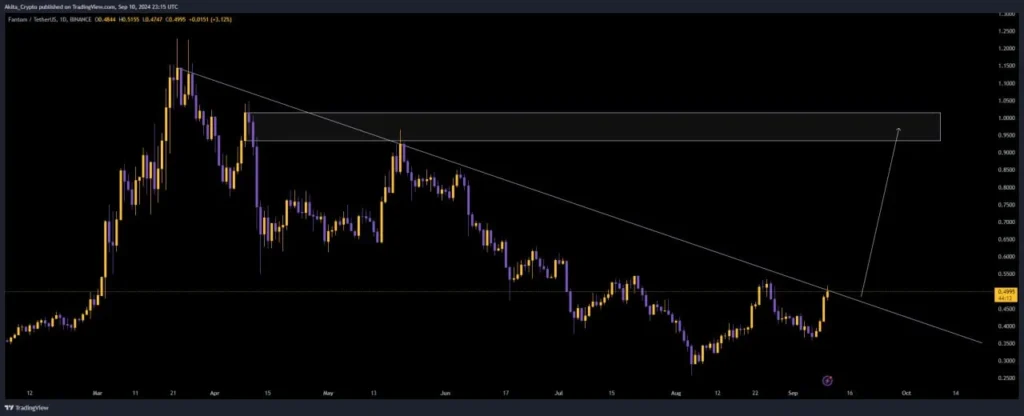

FTM/USDT

FTM is preparing for a BreakOut!

With an upcoming rebrand from $FTM to $SONIC, we believe this BreakOut has a high probability!

We’re closely watching the chart formation and volume trends, which suggest increasing bullish pressure.

Stay tuned for official announcements regarding the rebrand timeline, as this could impact short-term price action.

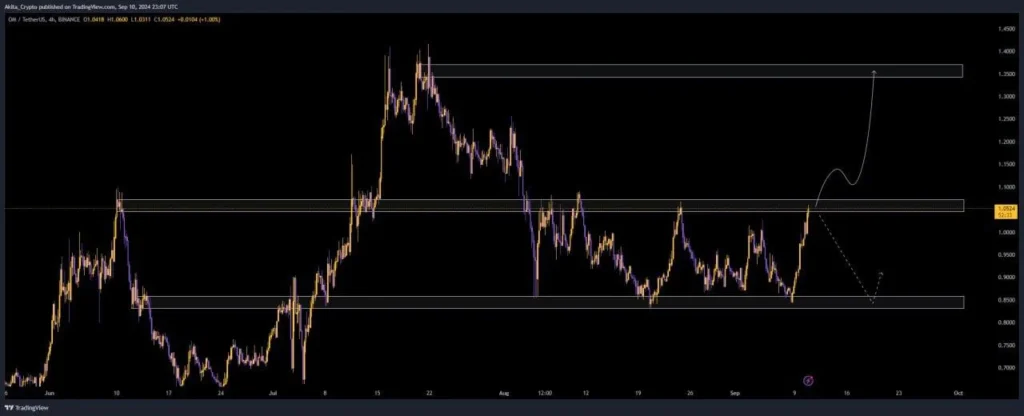

OM/USDT

OM (Mantra) is currently testing a Local Resistance.

Once Mantra will be able to hold above this level, we believe it will go straight to 1.35$!

We’re closely monitoring this crucial resistance test. A solid break and hold above this level could signal strong bullish momentum.

Key factors to watch:

- Volume increase on the breakout

- Consolidation patterns after the initial surge

- Any news or developments that could fuel the upward movement

Remember, 1.35$ is our target based on current market conditions and technical analysis. Always be prepared for potential pullbacks and manage your risk accordingly.

From AI-driven projects to DeFi tokens and ecosystem rebrands, there’s no shortage of compelling narratives driving price action. However, we always emphasize the importance of due diligence and risk management. While these opportunities look promising, the crypto market remains volatile and unpredictable. Happy trading, and we’ll see you in the next market update!