How can you use your digital assets to secure an NFT loan? Lending has long been the cornerstone of traditional banking, enabling the growth of the global economy. Traditional financial institutions worldwide offer lending solutions but with one standard—centralization. Despite traditional lending’s behemoth size, it has been unable to serve everyone. According to statistics, by 2021, there were over $1.4 billion unbanked adults worldwide, representing about a third of the adult population. Centralization leads to roadblocks, leaving many needing access to essential financial services. Enter the world of DeFi and NFT lending—a revolutionary way for individuals to access loans without traditional banking processes. Our guide today explores how NFT lending platforms work and how they transform the financial space by providing accessible, decentralized lending solutions for everyone.

What is NFT Lending?

NFT lending is one of the primary points of intersection between the two separate worlds of Decentralized Finance and Non-fungible tokens.

It refers to the process where owners or holders of Non-fungible tokens use their assets to access loan resources. Therefore, holders of attractive NFTs can enjoy a vast pool of liquidity or profits by simply loaning their assets out instead of selling. With NFT lending, your NFT assets will not remain idle in wallets.

Note this: Borrowers can benefit from the actual value of their NFTs without necessarily selling them, and lenders earn interest based on that value.

How Does NFT Lending Work?

Like other forms of DeFI lending, NFT lending involves a borrower depositing collateral to access a loan. In essence, the borrower can access loans whose value is only about a fraction of the value of these NFTs.

Typically, traditional lenders conduct thorough credit checks to determine the creditworthiness of their users. However, there are no such checks in NFT lending platforms, and there is no paperwork. Everything is done in a decentralized manner.

NFT lending platforms also operate with automation. The borrower and lender first agree on the loan terms, and the automated protocols handle the rest of the work.

However, lenders have the time to review the available NFTs and decide whether to offer loans. If a match is found, the borrower receives the agreed-upon amount in cryptocurrency.

The NFT is locked in an escrow smart contract during the loan period and only unlocked when the repayment is completed. This contract automates the process to bolster transparency and trust.

Failure to pay the loan plus the necessary interest before the duration means the borrower will not receive back their non-fungible tokens.

What Are The Types of NFT Lending?

Despite still being in its infancy, NFT lending has already grown enough to be grouped into various categories, including:

- Peer-to-peer (P2P) NFT Lending: In this type of NFT lending, the borrower and lender connect directly, determining the loan terms. The borrower gives their NFT as collateral — default to pay means the lender takes ownership of the NFT.

- Peer-to-Protocol (P2Protocol) NFT Lending: P2Protocol operates through the power of liquidity pools. A borrower deposits NFT collateral into a lending protocol and receives a loan. In this type of lending, the loan terms are predetermined by the protocol’s algorithm.

- Non-Fungible Debt Position (NDP): NDP is like traditional loans, where the borrower collateralizes NFT into a protocol, and a stablecoin or other crypto is issued against it. As long as the NFT is locked, the borrower can leverage it as collateral. However, after payment of the debt, this NFT is released.

- NFT Rentals: This is a model popularized in gaming and virtual real estate, where you rent out NFTs instead of using them as collateral. Users rent the assets for a duration, even paying the fees to owners.

The Design of NFT Loans

By design, NFT loans take a slightly different structure when compared to traditional loans, especially in the following facets:

- Collateralization: This refers to the locking of the NFT into a smart contract to ensure the borrower cannot move them till the loan is repaid.

- Loan amount: The loan offered is often a fraction (percentage) of the NFT’s market value. This is usually referred to as over-collateralization. The lender must assess the NFT’s value. Note that NFT values are volatile.

- Interest rate: The rates vary depending on the platform used and the risk involved. The NFT value also contributes to the determination of the interest rates.

- Repayment terms: The loan terms are defined in the smart contract. Only when the borrower meets these terms do they regain ownership.

- Liquidation: If the borrower defaults on the loan, the lender can claim ownership of the NFT, which they can then sell to recoup their funds.

Top NFT Lending Platforms

Below is a list of NFT lending platforms in the globe:

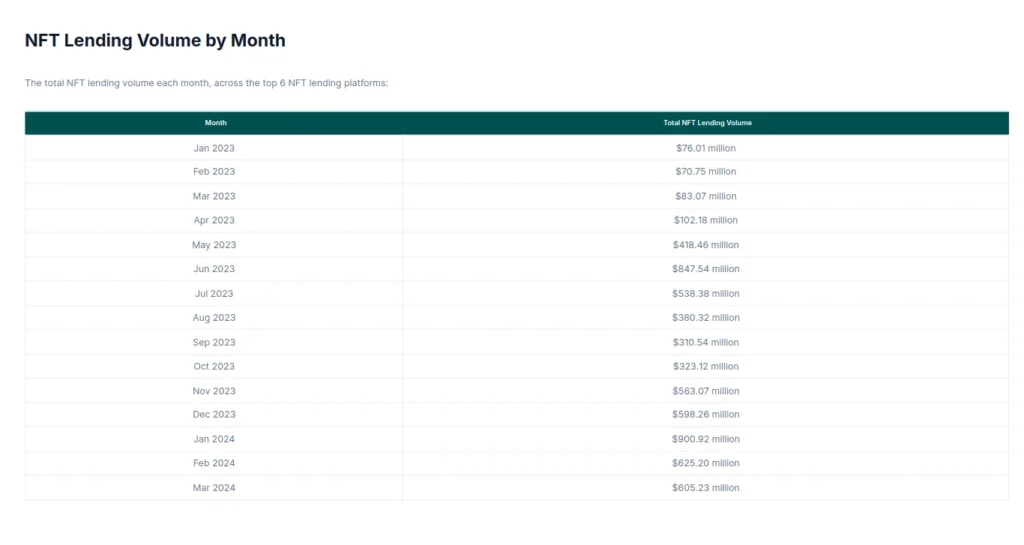

Coingecko analyzed the NFT lending universe, explicitly focusing on lending volumes from January 2023 to March 2024. The list indicates that between January 2023 and January 2024, the NFT lending volumes increased by over 1000%, from $76 million to over $900 million.

You may also like: Which Cryptocurrency Lending Platforms Are The Best

How To Access an NFT Loan

An NFT loan is the borrowing you access under NFT lending. As described above, NFT loans involve using digital assets representing ownership of unique items as collateral for loans.

All NFT loans are cryptocurrency or stablecoins, which must be paid back with interest.

But what are the steps involved in accessing NFT loans? Here they are:

Step 1: Choose an NFT Lending Platform

The first step to accessing an NFT loan involves selecting the right platform. Of course, the NFT market comprises platforms with great potential as NFT loan sites, including Blend, NFTfi, Drops, and Arcade.

From the available pool of NFT lending sites, it’s your job to research and identify the right spot to do your lending. Your research demands that you recognize the platform’s terms, interest rates, and user reviews to ensure they meet your needs.

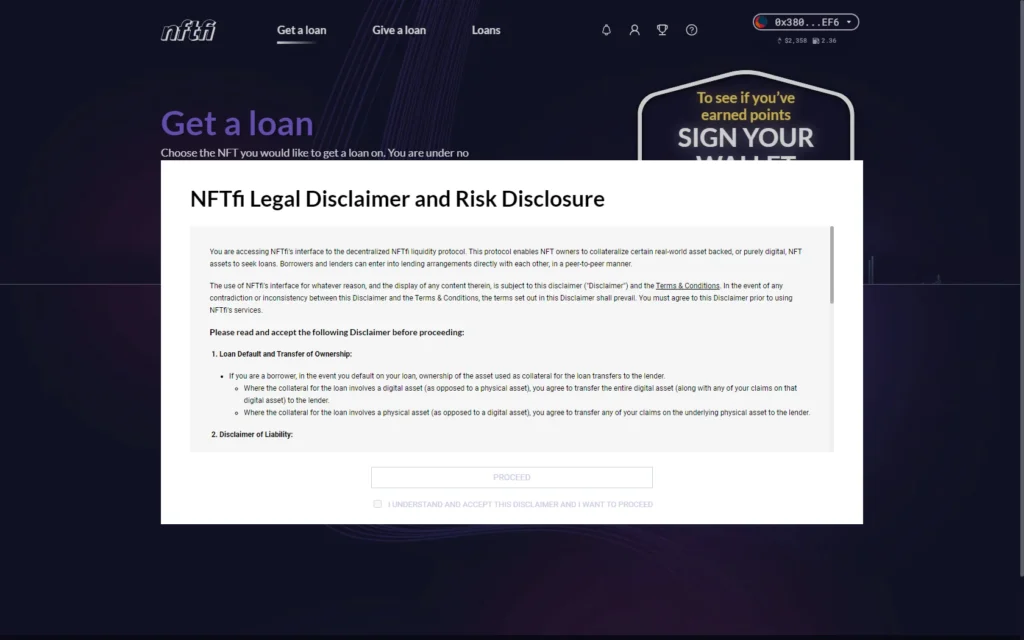

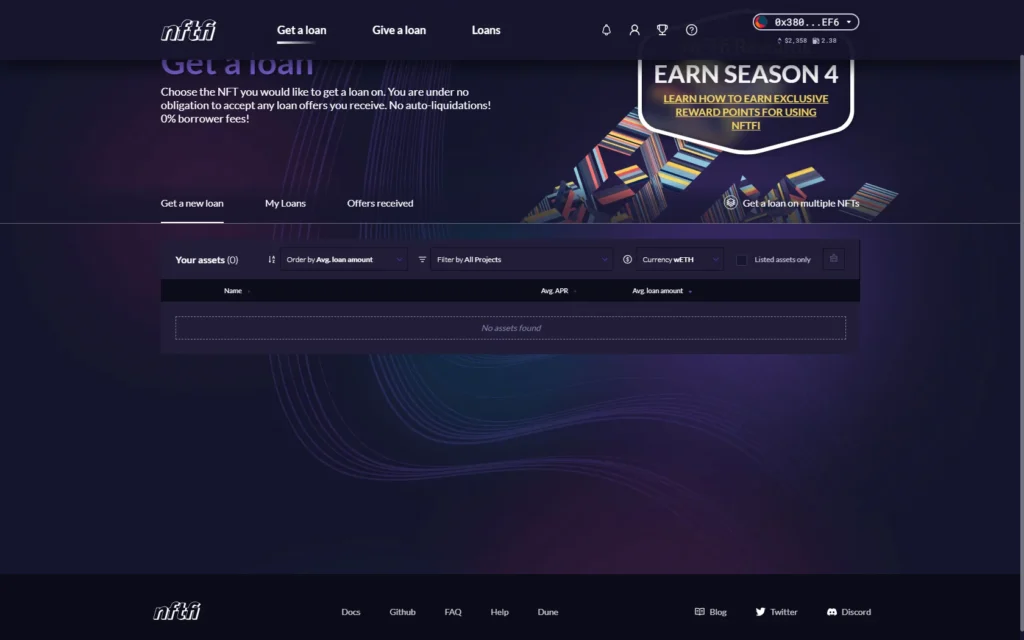

To write this article, we will use NFTfi as our go-to platform.

Step 2: Connect Your Wallet

This second step involves connecting the wallet holding your NFT to the lending site, in our case, NFTfi. As such, your NFT should be in a wallet compatible with NFTfi.

Click the ‘Connect Wallet’ tab on the NFTfi app. It’s at the top right corner of your homepage. Follow the necessary steps to complete linking. Once you link, you can view your assets via the NFTfi dashboard.

Step 3: List Your NFT as Collateral

The next step is listing your NFT/s as collateral on NFTfi.

Note: After linking your wallet to NFTfi, the lending platform can spot the NFTs in your wallet if you have any. Now, it’s your task to select which NFTs you aim to list as collateral.

At this point, you must also specify the loan terms you seek, including the amount, interest rate, and repayment duration.

Step 4: NFT Loan Offer and Acceptance

Following your listing, lenders will review your NFT collateral before submitting new NFT loan offers. These offers could be similar to or close to your needs.

The lenders submit offers based on their NFT collateral valuation and risk tolerance. Hence, in some cases, you could receive offers way below your target.

The big question is, how do lenders assess the value of NFT collateral loans?

NFT lenders use Oracles and third-party evaluators in NFT valuation. The lenders strive to obtain the latest information on the NFT’s market value. Oracles bridge blockchain-based systems and external data sources, bringing crucial information on sales prices, market demand, and other economic indicators.

Third-party evaluators also play a critical role in NFT valuation by bringing specialized knowledge and expertise. Here is what the third-party evaluators consider when valuing NFTs:

- Rarity

- Creator’s reputation

- Historical sales

Review the offers and accept the one that best suits your needs.

Step 5: Smart Contract Execution

After reviewing the available offers, the platform autonomously creates a smart contract that autonomously locks your NFT as collateral. You receive the loan amount based on the terms of the offer you accepted.

Step 6: Repay the Loan

It would help if you made your repayments based on the terms agreed upon in the schedule. On most platforms, you can offer an option to repay early without penalty.

Step 7: Retrieve Your NFT

After completely repaying the loan amount, the smart contract will release the NFT into your wallet. If you fail to repay the loan, the lender will take ownership of your NFT.

What Are The Risks Associated with NFT Lending?

Well, the NFT lending universe has its challenges. Below are some of the risks associated with lending in the NFT universe:

- Risk for borrowers: Borrowers who use NFTs as loans suffer significant risks, including liquidation and potential loss of their assets. The volatility of the NFT market leaves borrowers at risk of being liquidated if their assets lose value. Moreover, security issues online pose a risk of losing NFTs.

- Risks for lenders: The volatile nature of NFTs also affects the lenders. Sharp price changes could cause the assets to be under-collateralized, making it difficult to recover the total loan amount.

- Other risks include interest rate fluctuations, smart contract vulnerabilities, market liquidity issues, counterparty risks, platform risks, and general regulatory risks.

Benefits of Using NFTs as Collateral

Despite the risks, there are notable perks of using NFTs as collaterals when accessing loans in the digital realm. Some of the widespread benefits include:

- Access to liquidity without selling your NFTs. You don’t need to sell your NFTs to get liquidity to purchase other assets — take a loan with the NFT as collateral.

- Flexible loan terms — NFT lending has more flexible loan terms than traditional financial institutions.

- Privacy and anonymity — Owing to the decentralization afforded by NFT lending platforms, borrowers enjoy privacy and anonymity not afforded by conventional lending platforms.

- Passive Income Opportunities — NFT lending allows participants to earn passive income on idle capital.

Final World: NFT Collateral Loans

Our guide dug deep into NFT collateral loans, explaining how NFT holders can access loan facilities. The guide highlighted some of the best NFT lending platforms investors can consider when accessing NFT loans. Don’t dive unquestioningly into an NFT-backed debt—do thorough research.

FAQ – Frequently Asked Questions

NFT lending and borrowing protocols are decentralized platforms that allow NFT owners to use their digital assets as collateral for loans. These protocols enable NFT holders to access liquidity without selling their assets, while also providing opportunities for lenders to earn interest.

The lending rate for NFTs varies depending on factors such as the NFT’s value, market demand, and the specific lending platform. Rates typically range from 5% to 50% APR, but can fluctuate widely based on current market conditions and the perceived risk of the loan.

Some of the top NFT lending platforms include NFTfi, Arcade, and BendDAO. These platforms offer various features and loan terms, catering to different user needs in the NFT lending space.