The crypto market has seen massive growth over the past few years, and 2024 has been no exception. From market capitalization to user adoption, the numbers show clear upward trends. Here, we will break down these statistics, explain their importance, and discuss how they affect the overall market.

Key Takeaways

- Market Growth: The crypto market saw a 60% growth in Q1 2024, driven by Bitcoin and Ethereum gains.

- Investment Flows: ETFs and venture capital funding surged, with the U.S. leading in crypto investments.

- Adoption: Female ownership in crypto jumped to 29%, and 63% of current owners plan to increase their holdings.

- Platform Dominance: Ethereum remains dominant in DeFi, with Solana growing in total value locked (TVL).

- Future Projections: Crypto market cap expected to reach $4.59 trillion by 2028 with a 16.5% growth rate annually.

1. Market Growth Statistics

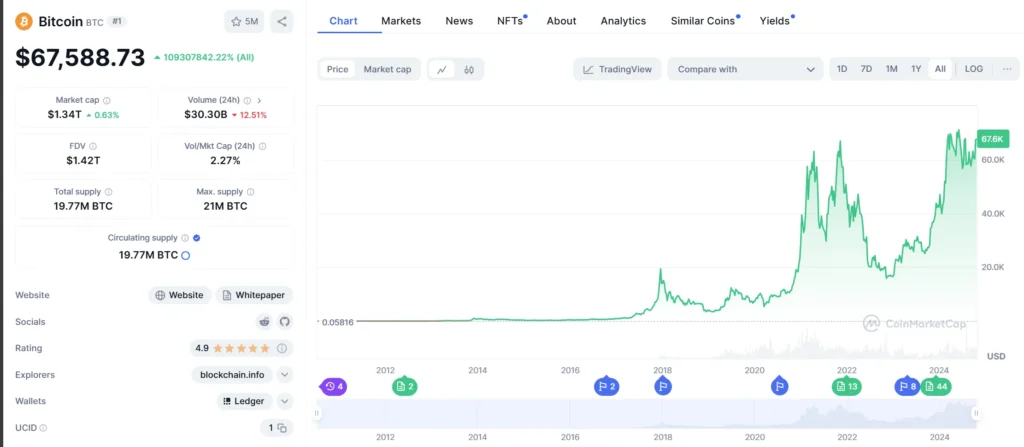

The crypto market cap grew from $1.773 trillion to $2.837 trillion in Q1 2024, marking a 60% increase. The driving force behind this surge was Bitcoin with a 61.1% rise and Ethereum with a 41.8% increase during this period. This remarkable growth indicates increased investor confidence and broader acceptance of digital assets.

Why it Matters

Market growth is the lifeblood of any industry, and crypto is no different. With such significant gains, it’s clear that cryptocurrencies are no longer a fringe investment but are becoming mainstream.

2. ETF Performance

Exchange-Traded Funds (ETFs) have played a crucial role in attracting institutional money. BlackRock’s ETHA ETF had net inflows of $354.8 million, followed by Bitwise’s ETHW fund with $249.9 million, and Fidelity’s FETH fund with $180.1 million. These numbers highlight the growing appetite for crypto-focused financial products.

ETFs make it easier for institutional investors to enter the crypto market. As more traditional financial products adopt crypto, we can expect even more capital to flow into this space.

3. Venture Capital Activity

The money’s flowing where the innovation is. Crypto projects secured 40% more funding in 2024 compared to previous years, with the DeFi sector capturing 25% of total investments. The U.S. led the charge, with $785 million in crypto investments, followed by Hong Kong with $124 million. These aren’t just numbers – they’re bets on crypto’s future.

Venture capital activity shows where the smart money is going. DeFi, in particular, is gaining traction, which could mean more innovation and adoption of decentralized finance solutions.

4. User Demographics and Adoption Metrics

Adoption is not only growing but also diversifying. Female crypto ownership rose from 18% to 29%, and 21% of non-owners are more likely to invest due to the approval of ETFs. Additionally, 63% of current crypto owners plan to acquire more crypto, indicating ongoing interest.

As crypto adoption grows across different demographics, the market’s long-term prospects become even stronger. Adoption is often the catalyst for wider acceptance and institutional participation.

5. Platform Dominance: Ethereum and Solana

Ethereum continues to dominate the DeFi market with 70% market share, but Solana is making waves by surpassing BNB Smart Chain with $8.7 billion in TVL (Total Value Locked). Multichain platforms also saw their TVL grow by 78%, from $83 billion to $147 billion.

Ethereum remains the go-to platform for decentralized finance, but Solana’s rapid growth could position it as a formidable competitor in the coming years.

6. Market Share Distribution

As more blockchains compete for dominance, it’s crucial to keep an eye on where the liquidity is going. With Solana surpassing BNB Smart Chain and Ethereum maintaining its position, it’s clear that developers and investors are diversifying their bets across various platforms.

Market share distribution tells us where the power lies in the crypto ecosystem. As new players like Solana rise, the market becomes more competitive, driving innovation.

7. DeFi Growth

The DeFi market cap rose by 49% since January 2024, showing that decentralized finance is no longer just a niche sector. As more capital flows into DeFi protocols, the decentralized economy will only continue to grow.

DeFi represents the future of finance. The more it grows, the more traditional finance institutions will feel the pressure to integrate decentralized solutions.

8. Future Market Projections

According to forecasts, the total crypto market cap could reach $4.59 trillion by 2028, with a compound annual growth rate (CAGR) of 16.5%. Blockchain technology in banking is also projected to hit $27.69 billion by 2028.

The crypto market isn’t slowing down. With these growth projections, the next few years could see unprecedented levels of investment and innovation.

9. Multichain Ecosystems

Multichain technology is making the crypto market more efficient and interconnected. The increase in Total Value Locked (TVL) across chains by 78% shows that multichain ecosystems are becoming the norm rather than the exception.

A multichain future is one where assets can easily move across different blockchains, creating a more interconnected and flexible market.

10. Investment Trends: Institutional and Retail

Both institutional and retail investors are playing a critical role in the market’s growth. The surge in ETF inflows and venture capital funding shows that institutional players are taking crypto seriously. On the retail side, we see growing interest, especially with the approval of crypto ETFs.

As more institutional money flows into the market, the volatility typically associated with crypto could decrease, making it a more stable investment class.

11. The Role of Regulation

With the growing interest in crypto, governments are starting to play a more active role in regulating the market. While regulation can sometimes stifle innovation, it can also provide the clarity that institutions need to enter the market confidently.

Regulation could be the key to mainstream adoption. As governments clarify the rules around crypto, more institutional players will likely get involved.

12. FAQs

The crypto market grew by 60% in Q1 2024.

Ethereum has the most established ecosystem, making it the preferred choice for DeFi applications.

ETFs make it easier for institutional investors to access crypto, driving more investment into the market.

The total crypto market cap is expected to reach $4.59 trillion by 2028.

Solana has surpassed BNB Smart Chain in Total Value Locked, making it a growing competitor to Ethereum.