The term Ethereum killers is increasingly gaining traction as more homes for Dapps and DeFI arise. These projects earn the name for their primary objective of challenging Ethereum for the top spot as a Dapp home. The idea of their launch is to offer an improved environment for DApps.

However, in the deep corners of the Cosmos ecosystem lies a unique project that possesses the capacity to challenge Ethereum but has no such intentions. And, of course, the project is the Injective Protocol.

What is the Injective Protocol?

In layman’s terms, Injective Protocol is a blockchain-based platform purposely crafted to recharge the DeFI world. Its primary focus is fueling next-gen DeFI applications, including lending protocols, spot exchanges, prediction markets and decentralized derivatives.

It is akin to Ethereum and Solana, both excellent platforms for Dapps and DeFI. But, Injective comes with a twist – universal compatibility.

The Cosmos SDK-based platform effortlessly integrates with Ethereum, IBC-enabled chains, and even non-EVM chains like Solana. The endgame? A truly decentralized cross-bridging network for DeFI.

Is Injective Protocol simply a Layer 2 solution? Not! Based on Cosmos SDK, Injective stands shoulder to shoulder with Ethereum, Solana, and other DeFI homes.

When writing this report, the Injective network has over 100 projects and 150K community members globally.

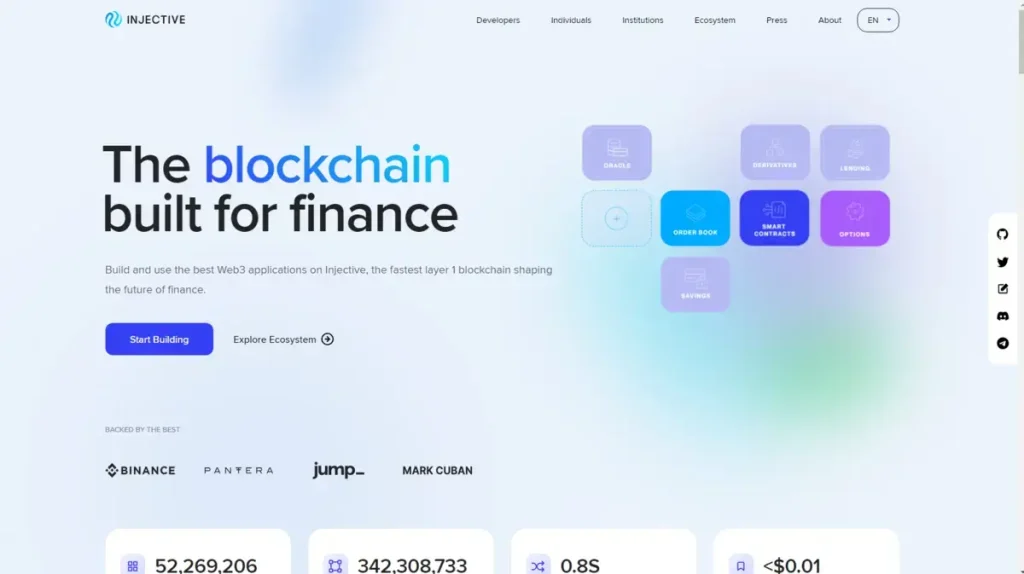

Who are the Backers of the Injective Protocol?

Born of the ambition of Erick Chen and Albert Chon, Injective soon earned backing from several top crypto networks, including:

- Binance

- Pantera

- Jump

- Mark Cuban

What are The Key Elements of Injective?

So, what separates Injective Protocol from its other peers? Injective combines a next-gen financial infrastructure for building DeFI comprising of the following attributes:

- Smart contract-focused L1 blockchain bringing top speed and zero gas fee on its trading platforms.

- Community governance, where users vote through the DAO structure for innovations

- Injective fosters interoperability with blockchains like Ethereum, Solana, Cosmos and many more

- The platform offers the ability to build different types of DeFI applications using the robust Injective infrastructure.

- Ability to trade and generate yield with different assets across different chains like Ethereum and Cosmos

- Lower Carbon footprint owing to the use of Tendermint PoS.

How Does Injective Protocol Work?

To enable a seamless DeFI operation, Injective leverages a smart contract-enabled blockchain, an exchange and a general hub.

Injective Chain (The Home for Decentralized Exchanges)

As a blockchain network, Injective relies on the Tendermint PoS consensus system, which was created to bolster performance and functionality. The reliability of PoS brings instant transaction finality and high performance, making Injective a good home for financial applications.

Tendermin enables Injective to attain instant transaction finality with lightning-fast speeds, hitting 10K TPS.

At the heart of Injective smart contract support is Cosmwasm, which offers more advanced cross-chain features. Due to the cross-chain functionality, developers can create Dapps that can freely operate on other chains.

This chain, which also functions as a DEX protocol, offers space for trading tokens.

The idea behind the chain is to bolster scale and throughput while allowing developers to leverage the Ethereum development kits. Injective Protocol allows users to access services like auctions, exchanges, oracles, insurance and bridges.

Injective Exchange

This is a decentralized platform following an order book model. It functions by matching the buy and sell orders in a hugely verifiable way.

Interestingly, the network made all the facets of this exchange, from the UI to the smart contract, completely open source.

Moreover, Injective incorporated a feature called Trade Execution Coordinator (TEC), which helps deal with trade front running and unfair trade practices.

Injective Hub

Injective Hub is a dashboard that enhances user experience on the Injective Protocol. Owing to the power of this platform, users can stake INJ tokens and act as network validators in the proof of stake system adopted by Injective.

Moreover, the hub provides a platform for governance of the Injective protocol. The issues voted on include future courses, new trading pairs, more functions, etc.

INJ, Injective’s Native Coin

At the heart of the Injective Protocol is the native token INJ, which was introduced to help power the network. So, what is the role of an INJ?

- Tendermint proof of stake — The coin helps provide more security to the injective protocol through the PoS mechanism, validators and delegators.

- Network governance – Holders of this coin can participate in the governance of the Injective network. After the mainnet launch, the Injective community has been active in network governance through votes.

- Incentives for the network developers — 40% of the fees collected via Injective incentivize new developers to build more on Injective. 60% of the fees go to the buy-back and burn system.

INJ coin has been performing quite well in the markets in recent weeks. When writing this report, INJ was trading at $39.3 and was trending upwards for at least its preceding 30 days. In 2023, INJ gained value by over 2700%, making it one of the year’s biggest gainers.

Where Can You Buy INJ?

With the price performance of INJ seemingly pleasing many investors, the question asked is, where can I buy the coin? You will be pleased to know that the asset is already listed in several top centralized crypto exchanges.

Among the centralized exchanges supporting INJ include:

- Binance – The popular pairs include INJ/USDT, INJ/TRY and INJ/BTC

- Coinbase – Available under the INJ/USD pair

- Kucoin — INJ/USDT is the most popular pair

- Bybit — INJ/USDT

- Gate.io – INJ/USDT

- OKX– INJ/USDT

- Kraken – INJ/USD and INJ/EUR

The Concept of AI Coins vs INJ

AI coins and tokens are blockchain-based assets introduced into the market as part of an AI project. These tokens are part of a crypto AI project.

The recent hype around AI tokens is a child of the Chat GPT mania, which began a few years ago. Since the emergence of Chat GPT, we have seen other major players introduce Artificial Intelligence projects.

This massive hype caused the rise of AI cryptocurrency projects. Injective is a product of the DeFI and AI hype and brings AI solutions in the Decentralized Finance realm.

Comparison Between Injective and Other AI Tokens

| Injective Protocol | Competitors |

| Injective bring AI plus DeFI solutions | Most AI tokens are purely AI |

| Based on Cosmos, hence enjoys multi-chain compatibility | Not many AI token can boast Multi-chain compatibility |

| Has been in the industry for the long term. | Most AI tokens are only just coming up. |

What Gives the INJ Coin Value?

The INJ Coin earns its value from its many use cases across the Injective Protocol. It is hugely valuable in Proof of Stake Security, Governance, Relayer Incentives, Exchange Fee Value Accrual and Collateral Backing For Derivatives.

PoS and Governance are already well explored above.

The Injective protocol implemented Relayer incentives, which incentivize relayers who originate orders. The relayers earn about 40% of the trading fee as INJ. The idea is to incentivize people to participate in providing liquidity within Injective.

Secondly, the network implemented a burn feature for the INJ token. 60% of the fees collected will be burnt.

In essence, the idea here is to bring in a deflationary system, helping bolster the remaining tokens’ value with time.

Finally, collateral backing for derivatives. INJ will act as a margin and collateral in the network’s derivative markets. The coin can enjoy additional demand and utility. These merged mechanisms help to bolster the overall value of INJ.

Why Use INJ?

What’s in it for developers and average users? Why should you use INJ and Injective Protocol in general? Here are four key reasons:

- Lower gas fees – There is no need to explain how Ethereum gas fees have harassed users and project creators. Injective Protocol brought a better solution with lower gas.

- Efficiency and transparency – Injective’s blend of an order book model and a decentralized exchange affords more transparency and efficiency

- Earning potential – Investors can earn on their holdings by delegating their INJ with validators. As a result, they will earn a portion of the INJ rewards.

- Developer friendliness – Developers wanting to build more efficient blockchain apps can use their trusted toolkits and programming languages within the Injective Protocol.

Final Word

To sum up, Injective Protocol is a disruptive force in the DeFI landscape, offering a platform that promotes innovation, universal compatibility, and user governance. It challenges platforms like Solana, providing a home for Dapps that connect with other chains.

Its features, zero gas fees, interoperability with other blockchains, and community governance set it apart from its competitors. Injective Protocol offers myriad opportunities, whether you are a developer or an investor.

Frequently Asked Questions

Injective provides a strong infrastructure for various applications in the DeFI space, enabling decentralized cryptocurrency trading. Moreover, users can create and trade derivatives like futures and options. Additionally, Injective supports smooth asset transfers between various blockchains.

Thanks to a well-designed architecture and advanced technologies, Injective achieves a transaction throughput exceeding 10,000 TPS.

Yes, several promising Injective NFT collections are moving forward. Examples include ‘The Ninjas’, a popular collection and part of the Ninjaverse.

Injective Protocol aims to integrate more cross-chain assets, add new derivative products, and develop advanced trading tools and features.